Introduction

Kenya is one of the fastest-growing economies in Africa, attracting both local and international investors. From real estate and agribusiness to technology and manufacturing, opportunities are abundant. However, success doesn’t come from chance—it requires careful planning, due diligence, and execution. This is where an investment checklist in Kenya becomes vital.

In this guide, we will outline a practical investment checklist that every entrepreneur, property developer, or investor should use before committing capital. We’ll also highlight what competitors often overlook: regulatory requirements, cultural considerations, financing realities, and long-term risk management.

Whether you’re investing in a serviced apartment in Nairobi, setting up a startup in Mombasa, or buying farmland in Eldoret, this checklist will help you avoid costly mistakes and maximise returns.

Why Use an Investment Checklist?

An investment checklist in Kenya helps you:

- Reduce risks by spotting red flags early.

- Standardise your decision-making process.

- Ensure compliance with legal and financial requirements.

- Compare different opportunities objectively.

- Avoid emotional or rushed investment decisions.

Think of it as your roadmap to smarter, safer, and more profitable investing.

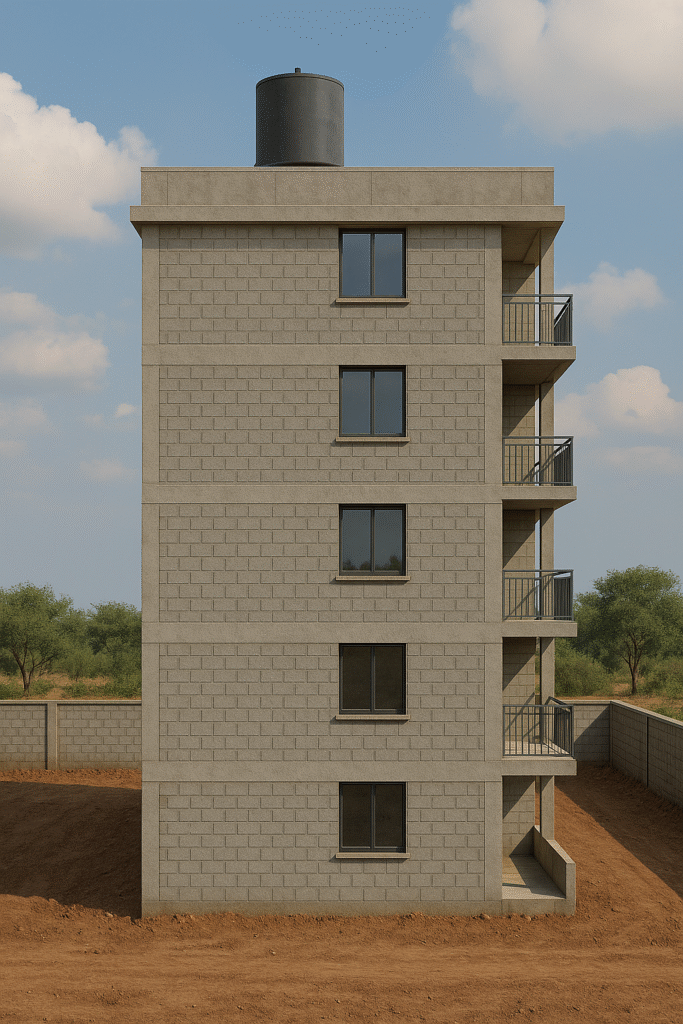

Related post: Designing and Constructing Modern 5-Storey Commercial and Apartment Buildings: A Blueprint for Success

Related post: Secret Exposed! How much does it cost to build a 4-bedroom house in Kenya?(Updated 2025)

The Ultimate Investment Checklist in Kenya

1. Define Your Investment Goals

- Are you seeking short-term cash flow (e.g., Airbnb rentals) or long-term appreciation (e.g., land near upcoming highways)?

- Clarify if your focus is wealth growth, income generation, or diversification.

2. Research the Market

- Study demand and supply trends in your target sector.

- For real estate, analyse rental prices, vacancy rates, and property appreciation in neighbourhoods like Kilimani, Ruaka, or Kitengela.

- For other sectors, check growth forecasts, competition, and consumer trends.

3. Legal and Regulatory Compliance

Kenya has specific regulations for each investment sector. Your checklist must include:

- Business Registration: Ensure your company is registered with the Business Registration Service (BRS).

- Tax Compliance: Get a KRA PIN and comply with VAT, PAYE, or corporate taxes.

- Real Estate Laws: Titles must be verified at the Ministry of Lands to avoid fraud.

- Sector Licenses: For example, SACCOs require SASRA approval, while hotels need Tourism Regulatory Authority licenses.

Related post: PR032-15 units Mixed Bedsitter and One Bedroom House Plans in Kenya

4. Location and Infrastructure

Location remains king in Kenyan investments. For property:

- Is the area secure?

- Does it have good roads, water, power, and internet connectivity?

- Are schools, hospitals, and shopping centres nearby?

For other businesses: - Is the target market accessible?

- Are logistics and transport costs manageable?

5. Financing and Budgeting

- Assess the amount of capital you need upfront.

- Explore financing options: bank loans, SACCOs, private equity, or joint ventures.

- Calculate ROI using tools like the real estate ROI calculator in Kenya.

- Include hidden costs such as legal fees, licensing, or marketing.

6. Risk Assessment

Every investment carries risks. Key risks in Kenya include:

- Regulatory changes (new taxes, zoning laws).

- Currency fluctuations (especially for foreign investors).

- Political risks (elections may slow business).

- Market risks (oversupply of apartments in Nairobi can lower rents).

Your checklist should include a mitigation strategy for each.

7. Operational Plan

Ask yourself:

- Who will manage the investment?

- Do you need a property manager, business partner, or skilled workforce?

- What technology or systems will streamline operations?

8. Exit Strategy

Investors often forget this step. Decide:

- Will you sell after a certain appreciation target?

- Will you refinance to release equity?

- Will you hold long-term for passive income?

Example: Investment Checklist for Serviced Apartments in Nairobi

Serviced apartments are booming thanks to rising demand from business travellers, expats, and digital nomads. Let’s apply the checklist:

- Goals: Generate Ksh 200,000 monthly passive income.

- Market Research: High demand in Westlands, Kilimani, and near JKIA.

- Legal: Confirm zoning, licenses, and lease terms.

- Location: Close to malls, highways, and offices.

- Financing: Mix of savings and mortgage.

- Risks: Airbnb policy changes, fluctuating occupancy rates.

- Operations: Hire a professional property management.

- Exit: Sell in 10 years when property value doubles.

This structured approach helps avoid surprises and secures profitability.

Mistakes to Avoid in Kenyan Investments

- Ignoring due diligence on land titles.

- Overleveraging with loans that eat into ROI.

- Choosing poor locations to cut costs.

- Failing to comply with taxes and licenses.

- Underestimating operating expenses.

Tips for First-Time Investors

- Start small, then scale.

- Use professionals like lawyers, valuers, and property managers.

- Diversify across sectors (real estate, stocks, agribusiness).

- Leverage technology for marketing and management.

- Network with established investors for mentorship.

Related post: Best Building and Construction Company in Kenya

Conclusion

An investment checklist in Kenya is not just a formality—it’s your roadmap to making informed, profitable, and sustainable investment decisions. By considering legal compliance, market research, financing, risks, and operational strategies, you can position yourself ahead of 90% of investors who overlook these steps.

Whether you’re building serviced apartments in Nairobi or exploring other sectors, a proper checklist ensures your capital works harder for you.

Ready to start your investment journey? Partner with Marble Engineering and Construction Ltd, Nairobi’s trusted real estate development company. They’ll guide you through due diligence, construction, and management to guarantee maximum returns.

Pingback: Modern 3BR House Plan in Kisumu: Affordable, Stylish, and Perfect for Family Living - West Kenya Real Estate Ltd

Pingback: Comparing Bungalow vs Maisonette Construction Costs in Kenya - Construction in Kenya

Pingback: Are REITs in Kenya Worth It? A Deep Dive into REITs in Kenya - Real Estate Journal Kenya

Pingback: Top 10 Fastest-Growing Real Estate Towns in Kenya - West Kenya Real Estate Shop

Pingback: Tips for Negotiating Land Prices in Kenya Like a Pro - West Kenya Real Estate Ltd

Pingback: How to Finance Land Purchase in Kenya: Loans vs. Savings - West Kenya Real Estate Ltd

Pingback: ROI Build vs Buy Rentals Kenya – Should You Build Your Own Rentals or Buy Ready Apartments? - West Kenya Real Estate Shop

Pingback: Choosing Between Steel & Concrete in Kenya: Which Is Better?

Pingback: Common Mistakes Buyers Make When Purchasing Land in Kenya - West Kenya Real Estate Ltd

Pingback: Real Estate Market Outlook for Nairobi vs Secondary Cities in Kenya - Real Estate Journal Kenya

Pingback: Building vs Buying a Home in Kenya: Which Is Better? (Full 2025 Guide) - West Kenya Real Estate Shop

Pingback: Why Buy Property from Shop.WestKenyaRealEstate.com? Verified Listings Explained

Pingback: Affordable Land for Sale in Kenya — Best Deals on Cheap Plots (2025/2026 Guide)

Pingback: Foreign Investment in Kenya (2026): Africa’s Premier Destination for Strategic Capital

Pingback: Legal Risks in Off-Plan Property Developments — Off-Plan Property Risks in Kenya - Real Estate Journal Kenya

Pingback: Affordable, Mid-Market, or Luxury Property: Trends Shaping Kenya’s 2026 Market - West Kenya Real Estate Shop

Pingback: Smart City Construction in Kenya: Urbanization & Investment Opportunities - West Kenya Real Estate Shop

Pingback: Land Reforms in Kenya and Their Impact on Property Owners - Real Estate Journal Kenya

Pingback: How Transport Corridors Kenya Shape Property Investment Hotspots and Land Appreciation - West Kenya Real Estate Shop

Pingback: Top 10 Property Developers in Kenya – Ranked - West Kenya Real Estate Ltd

Pingback: How Infrastructure Projects Are Turning Nairobi’s Satellite Towns into Prime Real Estate Hotspots (2026) - Real Estate Journal Kenya

Pingback: Construction Site Inspections: The Complete Guide for Investors & Project Teams - Construction in Kenya