Compare the real 2025 costs, risks, timelines, and benefits of building vs buying a home in Kenya. See which option suits your budget, lifestyle, and long-term goals — plus actionable steps, financing options, and expert tips.

Introduction

Why the “Building vs Buying a Home in Kenya” Decision Matters

Why This Choice Is So Important for Kenyans

The decision between building vs buying a home in Kenya affects your budget, timeline, and long-term comfort. Many Kenyans want a place to call home, but the best path depends on money, lifestyle, and urgency. This is why comparing house construction vs buying Kenya options is important before committing.

Understanding the Current Market Conditions

Land prices are rising fast in major towns like Nairobi, Kiambu, and Nakuru. Developers are building more units, but construction inflation has pushed material costs higher. These changes make it even more important to compare the cost of building a house in Kenya per square metre with buying a ready home.

What This Guide Will Help You Decide

This article gives you a clear comparison of cost, risks, financing, timelines, and long-term value. It also uses updated 2025 data so you can make a smarter choice between building or buying. By the end, you will know which homeownership option fits your needs and financial goals.

Understanding the Two Homeownership Paths in Kenya

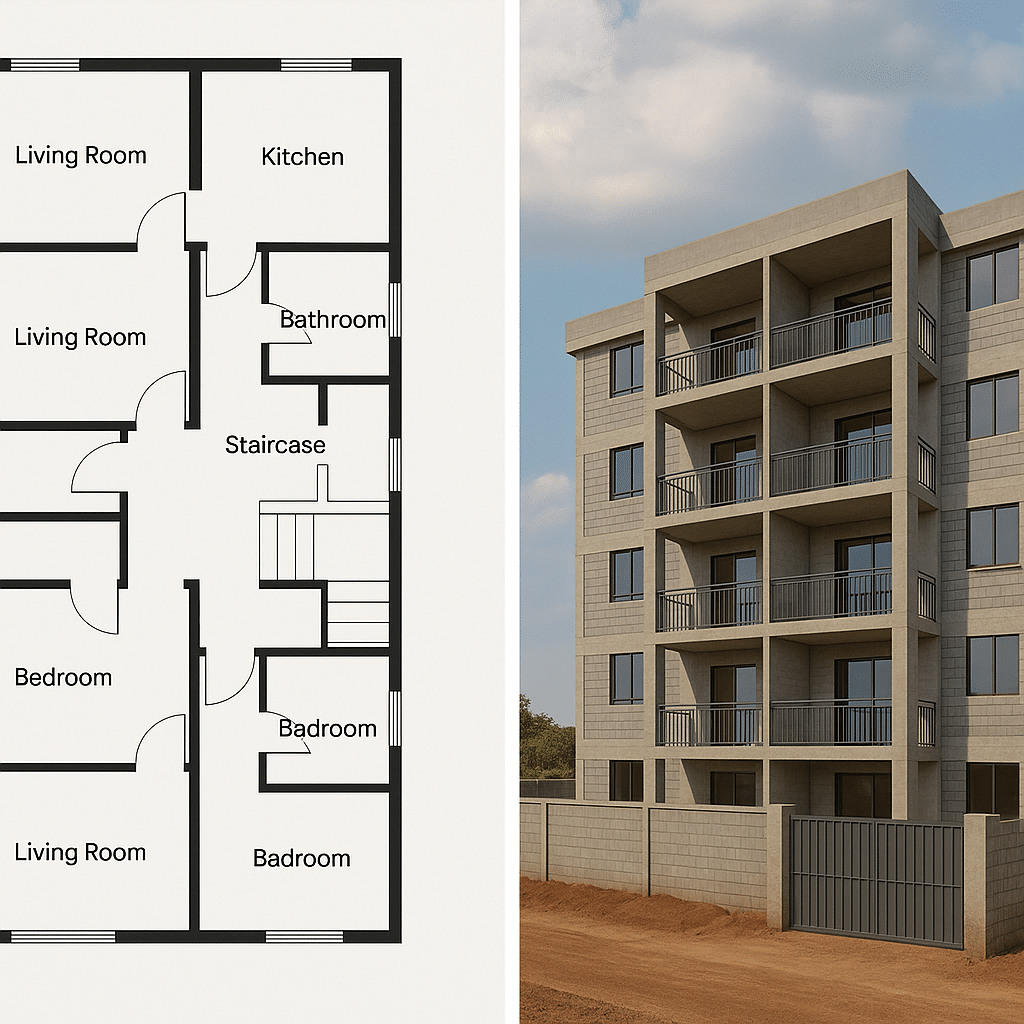

What Building a Home Really Involves (Land, Permits, Project Management)

Building a home in Kenya starts with securing land, confirming the title deed, and checking zoning rules, which ensures the plot is legal and ready for development. You then need architectural drawings, structural plans, and county approvals before any construction begins, and this process takes time and coordination. Once building starts, you must manage contractors, buy materials, oversee fundis, and monitor timelines, which makes project management a big part of the journey.

What Buying a Home Means (Off-plan, Ready Units, Resale Market)

Buying a home usually offers more convenience because you avoid the long approval and construction process, especially if you choose a completed unit. Off-plan homes can be cheaper and paid in stages, but they require trust in the developer’s track record and delivery timelines. Ready units and resale homes allow you to inspect what you are paying for, though older houses might need repairs or upgrades that add to the total cost.

How Urban vs Rural Locations Change the Decision

Urban areas like Nairobi and Kiambu often make buying more practical because land is expensive, plots are smaller, and demand for ready homes is high. In rural or peri-urban towns, land is cheaper and more spacious, making building a home more affordable and flexible for future expansion. However, rural areas may have weaker infrastructure—like poor roads or limited water supply—which can increase the overall cost of construction.

Cost Comparison — Building vs Buying in Kenya (2025 Data)

Cost per Square Metre for Building (Low, Mid, High-End Finishes)

Building a home in Kenya in 2025 depends heavily on finish level, location, and labour quality, which makes the building vs buying in Kenya decision more sensitive. Low-cost builds using basic materials now range between KSh 28,000–45,000 per sqm, especially in peri-urban counties where labour is cheaper. Mid-range homes with better tiling, cabinetry, and roofing average KSh 50,000–70,000 per sqm, while luxury builds with custom designs and imported finishes can exceed KSh 90,000 per sqm. These numbers help you compare whether constructing from scratch aligns with your budget and long-term goals.

Current Market Prices for Ready Homes (Affordable, Mid-Range, Luxury)

Buying a ready home gives predictable costs, which is a major factor when weighing building vs buying in Kenya. Affordable units in satellite towns like Kitengela, Ruiru, and Athi River currently range from KSh 3M–7M depending on developer quality and amenities. Mid-range homes in Nairobi’s fast-growing estates average KSh 9M–18M, while luxury units in areas like Kileleshwa, Westlands, and Karen start from KSh 25M and can go beyond KSh 60M. These price bands help buyers understand whether the convenience of a ready home outweighs the flexibility of building.

Land Costs Across Counties (Nairobi, Kiambu, Nakuru, Kajiado)

Land pricing affects the overall budget and is a major influence on the building vs buying in Kenya decision. Nairobi has the highest prices, with most plots in established suburbs costing between KSh 18M–50M for 1/8 acre, making it difficult for many first-time builders. Kiambu remains attractive for mid-level buyers with prices ranging from KSh 3M–12M depending on proximity to tarmac and utilities, while Nakuru and Kajiado offer more affordable land between KSh 600K–3M in well-serviced areas. These differences determine whether building is financially realistic in your preferred county.

Hidden/Surprise Costs Competitors Miss (Approvals, Site Prep, Services, Variations)

Many people underestimate hidden costs, which often shift the building vs buying in Kenya comparison. County approvals, architectural drawings, structural designs, and NCA fees can add KSh 150K–500K before construction even begins. Site preparation—such as clearing, fencing, soil tests, and connecting water or electricity—can raise your budget by another KSh 200K–600K depending on location. Variations and unexpected material adjustments also increase total spending, especially when inflation affects cement, steel, and roofing prices.

Opportunity Costs (Rent During Construction, Delays, Material Inflation)

Opportunity costs are a crucial part of comparing building vs buying in Kenya because they directly impact your cash flow. Many families continue paying rent for 10–20 months while constructing, adding a hidden KSh 200K–700K depending on their current rental house. Construction delays caused by weather, labour shortages, or slow approvals can also extend timelines, raising labour and material expenses. Inflation on steel, cement, timber, and transport may push your build budget beyond the initial projection if materials are purchased over a long period.

Timeline & Convenience Factors

How Long It Takes to Build a Home in Kenya (Best & Worst Case)

Building a home in Kenya can take anywhere from 6–12 months in the best conditions, depending on the design, county approvals, and how quickly materials are delivered. More complex homes or poor project management can push the timeline to 14–24 months, especially if the fundi teams slow down or weather interrupts progress. These variations make the building vs buying in Kenya decision heavily dependent on your flexibility, patience, and cash flow stability.

Time Savings When Buying Ready-Made Units

Buying a ready-made home saves months of waiting, which is one of the biggest advantages when comparing building vs buying in Kenya. Once paperwork is confirmed and payment is arranged, most buyers can move in within 30–90 days depending on loan approval or SACCO processing. This fast turnaround makes ready units ideal for families who want immediate stability without managing construction stages.

Complexity of Managing Contractors, Fundi Teams & Purchases

Managing a full construction project in Kenya requires constant supervision, decision-making, and coordination with contractors and fundi teams. You must track purchases like cement, timber, steel, tiles, and plumbing parts to avoid theft, wastage, or overpriced supplies. This makes building far more demanding compared to buying, especially for people with full-time jobs or limited construction experience.

Off-Plan Buying Timelines and Delivery Risks

Off-plan homes in Kenya usually take 12–24 months to complete, depending on the developer’s financing strength and project speed. While this option lets you lock in lower prices and pay in installments, the building vs buying in Kenya comparison becomes risky if the developer delays or fails to complete the units. Buyers must monitor progress to avoid handing over money to stalled projects.

Risk Comparison — Which Option Is Safer?

Building Risks (Contractor Fraud, Overruns, Quality Issues)

Building a home exposes you to risks like dishonest contractors, budget overruns, and poor workmanship if teams are not monitored closely. Many Kenyans face unexpected variations or inflated bills when fundis demand extra materials that were never planned. Without strong supervision and verified contracts, the building vs buying in Kenya decision can lean towards buying simply because construction risks feel overwhelming.

Buying Risks (Developer Collapse, Fake Titles, Structural Defects)

Buying a home also comes with serious risks, especially when dealing with new or underfunded developers. Some projects collapse mid-way, leaving buyers with losses, while others deliver homes with structural cracks or poor finishes. Fake titles or unclear land ownership can also trap buyers, making due diligence essential in the buying side of the building vs buying in Kenya debate.

Due Diligence Checklist for Both Options

Whether building or buying, due diligence helps protect your money from avoidable losses. For building, you must verify the fundi teams, check material quality, confirm approvals, and ensure every payment is documented. For buying, you must verify titles, confirm project financing, visit the site, and check the developer’s track record to avoid scams or collapsed projects. A strong checklist reduces risks on both sides of the decision.

Legal Considerations You MUST Check (Titles, NCA, NEMA, County Permits)

Legal checks are mandatory, and skipping them can lead to costly disputes or project shutdowns. You must verify land titles, confirm NCA registration for contractors, check NEMA approvals where required, and ensure county permits are valid before construction begins. These steps protect you from fraud, illegal builds, and future demolition risks, making them essential when comparing building vs buying in Kenya.

Customisation, Design Freedom & Quality Control

Build Option — Full Control Over Layout, Rooms, Materials

When you choose to build, you get complete control over the layout, room sizes, finishes, and materials used in your home. This freedom makes building attractive for Kenyans who want unique features like larger kitchens, custom wardrobes, or extra outdoor spaces. It also allows you to tailor the home to your lifestyle, which is a major advantage in the building vs buying a home in Kenya decision.

Buy Option — Limited Customisation & Standardised Designs

Buying a ready-made home usually means accepting standardised designs and limited customisation options. You may find that room sizes, window placements, finishes, or drainage layouts cannot be changed without costly renovations. This limits personal expression and is one of the reasons many Kenyans still prefer building over buying when they want a home that reflects their exact needs.

Energy Efficiency & Modern Green Features When Building

Building gives you the chance to incorporate energy-efficient features like proper insulation, solar power, rainwater harvesting, and natural lighting. These modern additions lower long-term bills and create healthier living spaces, especially in fast-growing towns. For many families, the ability to integrate green design becomes a key deciding factor in the building vs buying a home in Kenya comparison.

Future Expansion & Remodeling Potential (Build vs Buy)

Homes built from scratch make future expansion much easier because you can design the foundation and layout to allow extra floors or additional rooms later. Ready-made homes often limit expansion since walls, plumbing, and structural support are already fixed. This flexibility makes building more attractive for young families planning future growth.

Financing — How Kenyans Fund Their Homes

Construction Loans, Staged Payments & Self-Funding

Construction loans allow you to build step-by-step, with banks releasing money in stages based on project milestones. Some Kenyans avoid loans and choose self-funding, paying for materials and labour as money becomes available. This staged approach helps reduce pressure but can also slow down progress if cash flow is inconsistent.

Mortgage Options for Buying Ready Homes

Mortgages are the most common financing option for people buying ready-built homes, especially in Nairobi, Kiambu, and major towns. Banks and Saccos offer long-term repayment plans that make monthly instalments manageable. This financing model makes buying more predictable than building, which is why many urban buyers prefer ready-made homes.

Why Most Kenyans Build in Phases (Cash Flow Reality)

Many Kenyans build in phases because income often comes in small, irregular amounts rather than large lump sums. This phased-building approach makes homeownership possible without taking huge loans but also extends the construction timeline. It’s a practical method that aligns with the economic reality of many families across the country.

Sacco Loans, Joint Ownership & Coop Financing

Sacco loans are popular because they offer lower interest rates and flexible repayment terms, making them ideal for both building and buying. Some Kenyans also choose joint ownership with partners, siblings, or spouses to share the financial burden. Cooperative financing models help many families reach homeownership faster by pooling resources.

Location-Based Differences (Key Kenya Insight Competitors Miss)

Why Building Is Cheaper Outside Major Cities

Building a home outside major urban centers in Kenya is significantly cheaper because land prices are lower and labour is more affordable compared to Nairobi or Kiambu. Counties like Nakuru, Kajiado, Juja, and Kitengela offer larger plots for a fraction of the price, giving homeowners the ability to design spacious compounds and include extra rooms or amenities without inflating the budget. Although material transportation costs may increase slightly in more remote areas, the overall savings on land and labour usually outweigh these extra expenses. For families looking to maximise value and customise their home, building outside the city often becomes the preferred choice in the building vs buying in Kenya discussion.

When Buying Makes More Sense in Nairobi & Kiambu

In high-demand urban counties such as Nairobi and Kiambu, buying often becomes more practical than building due to limited land availability and high plot prices, which can make construction costs prohibitive. Ready homes in these areas provide buyers with immediate access to modern infrastructure, security systems, and neighbourhood amenities, which would otherwise take months or years to develop if building. Developers often deliver homes with high-quality finishes and established utility connections, reducing the risk of delays, budget overruns, or compliance issues. Therefore, for city dwellers seeking convenience, speed, and predictability, buying a ready home can outweigh the benefits of building.

Infrastructure, Transport, Sewer, Water — Impact on Cost

Infrastructure and utility availability are major factors that affect the total cost whether you choose to build or buy in Kenya. Poor road access in peri-urban areas can increase material transport costs, while properties lacking water, sewer, or electricity connections require additional investment to make the home livable. Areas with well-developed roads, reliable electricity, and nearby social amenities not only reduce upfront construction costs but also increase the property’s long-term resale value. Evaluating infrastructure is therefore essential in the building vs buying in Kenya debate, as it influences both initial costs and future maintenance expenses.

Lifestyle Factors — Space, Control & Convenience

Privacy, Compound Size & Personal Space When Building

Building a home allows you to design a private and spacious compound tailored to your family’s lifestyle, which is often difficult to achieve when buying ready-made units in dense estates. You can control setbacks, garden size, parking, outdoor leisure areas, and interior layout to create quiet zones and recreational spaces for children or guests. This flexibility also enables future expansions such as adding extra rooms, rental units, or hobby spaces without being constrained by the original design. For families valuing privacy, space, and long-term adaptability, building a home is often the better option in the building vs buying in Kenya decision.

Security, Amenities & Neighbourhood Standards When Buying

Buying a home in an established estate or gated community provides immediate access to security, amenities, and neighbourhood services, which reduces the need for extensive personal management. Security features such as perimeter fencing, guard services, and street lighting are usually already in place, while amenities like schools, hospitals, shopping centres, and transport links are conveniently nearby. These advantages save homeowners time, money, and stress, particularly for those unable to supervise construction or manage compound security themselves. For urban buyers prioritising convenience and safety, ready-made homes often outweigh the freedom of building.

Family Needs vs Young Professional Needs

Your lifestyle and household composition heavily influence whether building or buying makes more sense in Kenya. Families often need larger homes with multiple bedrooms, outdoor play areas, and future expansion potential, making building attractive for long-term comfort and flexibility. Young professionals, on the other hand, may prefer low-maintenance homes in convenient urban locations that reduce commuting time and provide easy access to work, social hubs, and services. Evaluating your household needs against the building vs buying in Kenya decision ensures your home aligns with both immediate lifestyle requirements and long-term goals.

Investment & Long-Term Returns

Resale Value Comparison (Built vs Bought Homes)

The resale value of a home in Kenya depends on location, build quality, and market demand, which is crucial in the building vs buying a home in Kenya decision. Custom-built homes can fetch higher prices if they offer unique layouts, premium finishes, or larger compounds, but poorly managed builds may lose value due to structural issues or delays. Ready-built homes in prime estates often sell faster because buyers trust the developer’s quality and existing infrastructure. Investors and homeowners must weigh whether the flexibility and potential premium of building outweigh the reliability and quicker turnaround of buying.

Rental Yield Potential in Different Areas

Rental yield varies by county and property type, impacting long-term returns for homeowners who build or buy. Urban centres like Nairobi and Kiambu provide higher rental yields due to demand from professionals and students, while peri-urban or rural towns often offer lower but more stable yields.

Key considerations include:

Built homes can attract premium tenants if they have modern layouts and added amenities.

- Ready homes in gated estates often command higher occupancy rates due to security and services.

- Rental potential should factor into the building vs buying in Kenya decision, especially for investors.

Appreciation Trends Based on Location & Home Type

Long-term appreciation depends on the county, property type, and neighbourhood development. Urban areas with growing infrastructure and commercial hubs tend to appreciate faster, making ready-built homes a safer investment. Peri-urban areas offer slower but steady appreciation, which can benefit owners who build homes tailored to modern needs. Monitoring trends helps homeowners forecast potential gains and make strategic decisions in the building vs buying in Kenya debate.

Emerging Housing Trends in Kenya

Prefabricated & Modular Homes

Prefabricated and modular homes are gaining popularity in Kenya because they reduce construction time and can be more cost-effective than traditional builds. Components are manufactured off-site and assembled on location, cutting down on labour costs and delays caused by weather. These options appeal to both urban and peri-urban homeowners seeking modern designs without the prolonged management of conventional builds.

Sustainable Eco-Building Materials (e.g., Mycelium, Interlocking Blocks)

Eco-friendly construction materials are becoming increasingly relevant for homeowners looking to combine sustainability with cost efficiency. Mycelium, interlocking blocks, and recycled materials reduce environmental impact while lowering long-term maintenance and energy costs. Building with these materials allows homeowners to customise their properties while benefiting from energy savings and modern green designs.

Gated Communities & Master-Planned Estates

Gated communities and master-planned estates offer security, amenities, and structured neighbourhood layouts, influencing both building and buying decisions. Ready homes in these developments are attractive for buyers seeking convenience, while custom-built homes may need to meet estate regulations. These estates are increasingly popular in Nairobi, Kiambu, and emerging towns, shaping modern homeownership preferences.

Digital House Plans & Online Cost Estimators

Digital house plans and online cost estimators are transforming how Kenyans approach building and buying homes. Prospective builders can visualise designs, calculate material costs, and adjust layouts before construction, reducing risks and budget overruns. For buyers, these tools offer transparency on pricing and help compare off-plan units against custom builds, supporting informed decisions in the building vs buying in Kenya process.

Should You Build or Buy? (Decision Matrix)

If You Already Own Land — Best Choice

If you already own land in Kenya, building a home is often the most cost-effective and flexible option. You can design the house exactly as you want, optimise space, and plan future expansions without worrying about land acquisition costs. This makes building vs buying in Kenya heavily weighted toward construction when you have property ready, especially in peri-urban or rural areas where land is spacious and affordable.

If You’re on a Tight Budget — Best Choice

For those on a tight budget, buying an affordable ready-made home may be safer because it avoids unexpected construction overruns, inflation, and hidden costs. Building requires upfront payments for land, permits, materials, and labour, which may exceed initial estimates, especially if cash flow is inconsistent. Choosing a low-cost or mid-range ready unit allows you to move in faster while keeping your finances predictable.

If You Need a Home Fast — Best Choice

Time-sensitive buyers often find ready-made homes the better option because they allow quick occupancy, sometimes within 30–90 days after purchase. Even off-plan homes can be faster than starting a full construction project, which may take 12–24 months depending on approvals, labour, and material availability. For professionals or families needing immediate housing, buying reduces stress and delays compared to building.

If You Want Investment Property — Best Choice

For investors focused on rental yield or long-term appreciation, the choice depends on location and market trends. Built homes offer customisation that can attract higher-paying tenants or future resale premiums, while ready-made homes in high-demand urban estates are safer due to established infrastructure and developer guarantees. Comparing potential returns, occupancy rates, and appreciation trends helps determine whether building or buying maximises your investment in Kenya.

Quick Yes/No Checklist

Here’s a rapid decision guide for Kenyans weighing building vs buying:

- Own land? → Build

- Limited cash? → Buy affordable ready home

- Need to move in fast? → Buy

- Prioritise customisation? → Build

- Seeking reliable rental yield? → Consider ready units in high-demand areas

Action Steps — What to Do Next

How to Start Building (Land Search → Architects → Approvals)

To start building, first identify and verify land titles, considering zoning, access, and utility connections. Engage architects and structural engineers to prepare detailed drawings and bills of quantities, then submit for county and NEMA approvals. Once permits are in place, you can hire contractors, order materials, and plan phased construction according to your cash flow and timeline.

How to Start Buying (Developer Vetting → Mortgage → Inspection)

If buying, begin by researching reputable developers, checking their project history, and confirming legal titles. Arrange mortgage or financing options early to ensure smooth payments and timely handover. Finally, inspect the home thoroughly for quality, compliance, and finishing, avoiding hidden defects that can affect long-term value.

Mistakes to Avoid When Building or Buying in Kenya

Common mistakes include skipping title verification, ignoring hidden costs, failing to monitor construction progress, and underestimating material inflation. For buyers, risks include purchasing off-plan homes without checking the developer’s track record, or ignoring infrastructure and neighbourhood issues. Avoiding these mistakes reduces financial stress and ensures a smoother homeownership experience in Kenya.

Recommended Professionals to Work With (Architects, Realtors, QS, Lawyers)

A successful home project relies on experienced professionals: architects for design, quantity surveyors (QS) for budgeting, realtors for market guidance, and lawyers for title verification and contract checks. Engaging trustworthy contractors and fundis is also critical for construction quality. For buyers, professional inspections and legal checks safeguard your investment and ensure compliance with regulations, making the building vs buying in Kenya decision less risky.

Pros & Cons Summary (Side-by-Side Comparison)

Building a Home in Kenya

- Cost: Potentially lower if you already own land, but risks hidden overruns and material inflation.

- Customisation: Full control over layout, finishes, green features, and future expansion.

- Time: Construction can take 12–24 months, depending on approvals, labour, and cash flow.

- Risk: Exposed to contractor fraud, delays, and quality issues if not properly supervised.

- Resale Value: Can fetch higher prices if built with premium design and quality materials.

Buying a Home in Kenya

- Cost: Predictable, with financing options and fewer hidden expenses; ideal for tight budgets.

- Customisation: Limited; mostly standard layouts and finishes provided by developers.

- Time: Fast occupancy, often 30–90 days for ready units; off-plan homes take longer but less than building.

- Risk: Relies on developer reliability; potential issues include fake titles or structural defects.

- Resale Value: Generally stable, especially in prime estates with strong infrastructure and amenities.

Conclusion

Kenya’s housing landscape presents a unique choice between building and buying, influenced by location, budget, urgency, and long-term goals. Building offers maximum customisation and future expansion but requires patience, supervision, and risk management, while buying provides speed, convenience, and predictable costs, especially in Nairobi, Kiambu, and other high-demand urban areas.

For anyone deciding, the key steps are:

- Calculate realistic costs for both building and buying.

- Vet developers carefully and verify their track records.

- Check land ownership, zoning, and approvals before committing.

- Choose the path that aligns with your financial capacity, lifestyle, and investment objectives.

Taking these steps ensures your decision in building vs buying a home in Kenya maximises value, minimises risk, and meets your family or investment needs.