Introduction

Property investment in Kenya has become one of the most reliable ways to build long-term wealth. With a growing middle class, urbanisation, and infrastructure development, Kenya’s real estate market continues to attract both local and foreign investors. However, many aspiring investors are often unsure where to begin. Understanding the basics of property investment in Kenya is the first step toward making informed decisions, avoiding costly mistakes, and achieving strong returns.

In this article, we break down the essentials every beginner should know: property types, financing options, due diligence, risk management, and return on investment strategies. By the end, you’ll have a clear roadmap to confidently start your property investment journey in Kenya.

Why Property Investment Matters in Kenya

Property has historically been one of the most stable investment vehicles in Kenya. Unlike volatile assets such as stocks or forex trading, real estate generally appreciates over time, provides rental income, and serves as a hedge against inflation. Some key reasons to consider real estate in Kenya include:

- Growing demand for housing due to rapid urbanisation in Nairobi, Mombasa, Kisumu, Nakuru, and other urban centres.

- Infrastructure expansion, such as expressways, bypasses, and rail systems, opens up new investment zones.

- Diverse opportunities ranging from land banking, residential apartments, Airbnb units, to commercial spaces.

- Long-term security, as land and property are tangible assets that retain value.

Types of Property Investments in Kenya

Understanding the different property categories helps investors choose the right entry point. The main types include:

1. Land Investment

Land remains the most popular choice due to relatively lower entry costs and strong appreciation potential. Options include:

- Agricultural land for farming or speculation.

- Residential plots for building rental apartments or homes.

- Commercial land for business premises, shopping complexes, or mixed-use developments.

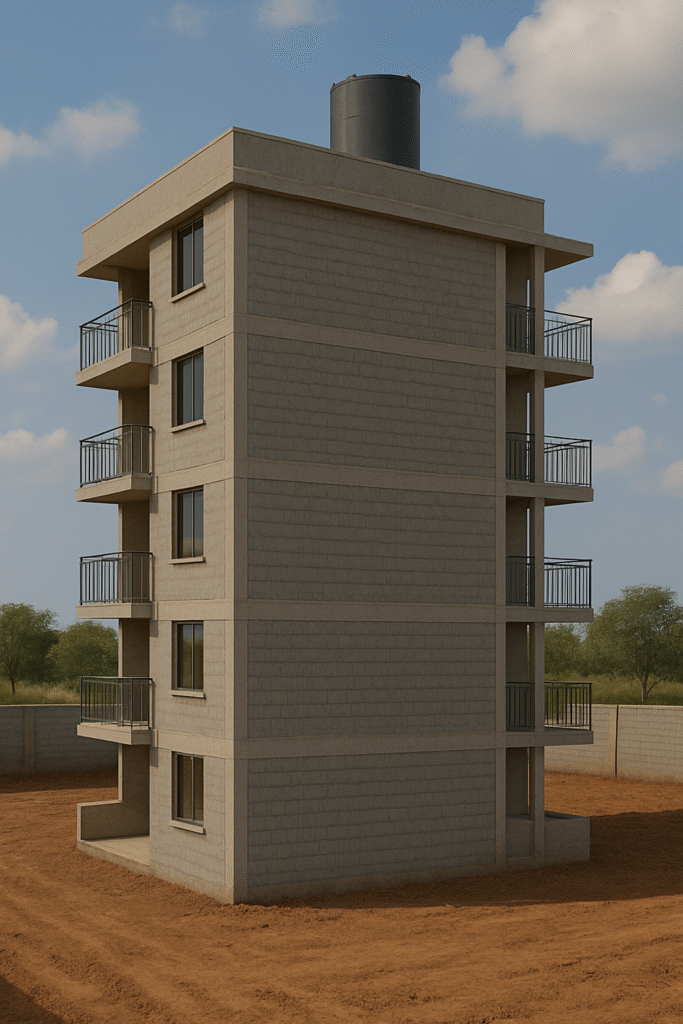

2. Residential Properties

This category includes single-family homes, maisonettes, apartments, and gated communities. Rental housing is in high demand in Nairobi’s estates such as Kileleshwa, Kilimani, Ruiru, and Syokimau. Investors earn through monthly rental income or capital gains when selling.

3. Serviced Apartments & Airbnb Units

The rise of short-term rentals has made serviced apartments in Nairobi highly profitable, especially for investors targeting business travellers and tourists. Locations like Westlands, Kilimani, and Lavington offer high yields.

4. Commercial Properties

Office buildings, retail shops, and warehouses provide consistent rental returns. While entry costs are higher, so are the returns. With Kenya’s SME sector booming, demand for commercial spaces continues to rise.

Financing Options for Property Investment

Capital is often the biggest barrier for beginners. Fortunately, Kenya offers multiple financing avenues:

- Mortgage Financing – Commercial banks and SACCOs provide home loans with repayment periods of up to 25 years. Interest rates vary between 13% and 16%.

- Chamas and Investment Groups – Pooling resources lowers the burden and makes bigger investments possible.

- Developer Payment Plans – Many developers allow buyers to pay in instalments during construction.

- Personal Savings – A slow but debt-free approach to property acquisition.

Tip: Always evaluate affordability and ensure rental income (if applicable) can offset loan repayments.

Related post: Best Building and Construction Company in Kenya

Essential Due Diligence Before Investing

Due diligence is one of the most critical property investment basics in Kenya. Skipping this step can lead to fraud, land disputes, or financial loss. Key checks include:

- Verify title deeds at the Ministry of Lands to confirm ownership and legality.

- Conduct a land search to ensure the property has no encumbrances such as loans or disputes.

- Check zoning regulations with county planning offices to confirm allowed developments.

- Survey boundaries to avoid future conflicts with neighbours.

- Engage professionals (lawyers, valuers, architects) foran accurate assessment.

Risks in Property Investment and How to Manage Them

Like any investment, real estate carries risks. Common ones in Kenya include:

- Land fraud: Fake title deeds or double sales.

- Market oversupply: Especially in certain apartment segments in Nairobi.

- Delayed projects: Developers failing to deliver on time.

- Tenant default: Unreliable tenants leading to cash flow challenges.

Risk management strategies:

- Work with reputable developers and construction firms.

- Diversify your investments across property types and locations.

- Insure your property against fire, theft, and natural disasters.

- Maintain a contingency fund to cover unexpected expenses.

Related post: Secret Exposed! How much does it cost to build a 4-bedroom house in Kenya?(Updated 2025)

Estimating Returns: ROI in Property Investment

Return on Investment (ROI) is a vital metric. In Kenya, average rental yields range from 6% to 10% annually, with serviced apartments in Nairobi offering even higher returns (up to 12–15%).

Example ROI calculation:

- Purchase price of apartment: Ksh 8 million

- Monthly rent: Ksh 80,000

- Annual rent: Ksh 960,000

- ROI = (960,000 ÷ 8,000,000) × 100 = 12%

This shows the property is highly profitable compared to traditional investments like fixed deposits or government bonds.

Smart Strategies for Beginner Investors

To maximise returns, beginners should adopt the following approaches:

- Start small, scale gradually – Begin with a plot or a single rental unit before moving to large developments.

- Leverage prime locations – Proximity to transport hubs, schools, hospitals, and business centres enhances rental demand.

- Balance short-term and long-term goals – Mix high-yield rentals (Airbnb) with long-term appreciation assets (land).

- Stay updated with market trends – Monitor demand shifts, such as rising student housing or affordable housing projects.

- Engage professionals – Partner with construction companies like Marble Engineering and Construction Ltd for quality, compliant projects.

Related post: PR032-15 units Mixed Bedsitter and One Bedroom House Plans in Kenya

The Role of Professionals in Successful Property Investment

Many investors underestimate the importance of expert guidance. Professionals help avoid costly mistakes and ensure compliance with Kenyan building standards. Key experts include:

- Real estate agents – For market insights and property sourcing.

- Lawyers – For contracts and title verification.

- Architects and engineers – For design and construction oversight.

- Property managers – For tenant acquisition and management.

By collaborating with professionals, investors not only secure their assets but also maximise ROI.

Future Outlook of Property Investment in Kenya

The future of property investment in Kenya remains promising. The government’s Affordable Housing Program is creating demand for partnerships between private investors and the state. Additionally, infrastructure projects like the Nairobi Expressway, LAPSSET corridor, and Konza Technopolis will open up new high-value zones.

Emerging trends include:

- Growth in student housing investments around universities.

- Expansion of mixed-use developments combining retail, office, and residential spaces.

- Increasing adoption of green and sustainable building practices.

Conclusion

Understanding the basics of property investment in Kenya is the foundation for long-term success. From choosing the right property type, securing financing, conducting due diligence, to calculating ROI, each step plays a crucial role in building a sustainable investment portfolio.

Kenya’s real estate market is full of opportunities, but only well-informed investors will reap the rewards. By starting small, leveraging professional guidance, and adopting smart investment strategies, you can create a path to financial independence through property.

Related post: Best Building and Construction Company in Kenya

Call to Action

If you’re ready to begin your property investment journey in Kenya, partner with experts who understand the market and deliver quality developments. Marble Engineering and Construction Ltd provides professional construction and real estate solutions, helping investors bring their projects to life — from serviced apartments to residential estates.

📞 Contact Marble Engineering and Construction Ltd today and turn your property investment dreams into reality.

Related post: Designing and Constructing Modern 5-Storey Commercial and Apartment Buildings: A Blueprint for Success

Pingback: Real Estate Hotspots in Kenya: Where to Invest in 2025 - Real Estate Journal Kenya

Pingback: Technology Disruption in Real Estate: PropTech Solutions in Kenya - Real Estate Journal Kenya

Pingback: The Shift Towards Rental Housing: Is Homeownership Declining in Kenya? - Real Estate Journal Kenya