Practical investor’s guide to the ROI of student hostels in Kenya — step-by-step proforma, per-bed capex conversions, sample Nairobi vs. university-town models, financing & exit options, risk mitigation, and a downloadable spreadsheet to run your own numbers.

Introduction

The ROI of student hostels in Kenya continues to draw attention from serious property investors seeking consistent, high-yield returns. With an increasing number of students joining universities and TVET institutions each year, the gap in purpose-built accommodation remains significant. This guide helps you assess profitability, plan construction budgets, and make data-driven investment decisions. Whether you’re planning to build, buy, or partner on a project, this breakdown helps you understand the key numbers and maximise performance.

Executive Summary: Headline ROI & Investor Takeaway

Student hostels in Kenya deliver gross yields ranging from 10% to 18%, depending on the quality, design, and location. Well-positioned hostels near major campuses can recover initial investment in 6 to 8 years. Consistent demand from students ensures a stable cash flow that beats most other real estate options. This range positions hostels as one of the most attractive medium-risk, high-return investments in Kenya’s current market.

One-Line Decision Rule for Investors

The simplest way to gauge if your hostel project is profitable is by applying the 1% rule — monthly rent should be at least 1% of the total per-bed investment. For instance, if one bed costs KSh 500,000 to develop, it should rent for at least KSh 5,000 per month. This principle keeps investors grounded in achievable cash flow targets. It’s a quick litmus test for filtering viable opportunities.

What’s Included in This Guide and the Downloadable Proforma

This guide includes a breakdown of construction costs, ROI formulas, design strategies, financing models, and risk management. The downloadable proforma allows you to input your own costs, rent projections, and occupancy rates to calculate returns. By the end, you’ll understand how to fine-tune your investment to achieve strong performance.

Market Opportunity: Demand, Supply Gap & Hotspots

Enrollment Trends & Private Colleges — The Demand Base

Kenya’s student population has increased significantly as more institutions receive accreditation and expand intakes. Many universities cannot accommodate more than 30% of their students, forcing the majority to seek private housing. This unmet demand has created a profitable space for investors. It also ensures occupancy rates above 90% for well-located, affordable hostels.

Hotspots: Nairobi, Kiambu, Nakuru, Eldoret, Kisumu, Mombasa

The strongest student housing investment in Kenya opportunities are found in major education hubs. Nairobi remains the top performer in rent value, while Eldoret, Nakuru, and Kisumu offer better affordability and faster build approvals. Each town presents unique potential based on land cost, proximity to institutions, and population growth. Investors should compare expected returns and construction budgets before committing.

Market Players & Institutional Appetite

The entry of large-scale investors such as Acorn and Centum has legitimised the sector. Their projects show that purpose-built student accommodation is both scalable and lucrative. Smaller investors can partner through fractional ownership or develop independent hostels targeting mid-income students. This diversification increases liquidity and reduces overall risk exposure.

How to Calculate ROI for a Student Hostel (Playbook)

Define Your KPIs

Before construction, investors should identify the right performance metrics like gross yield, net yield, IRR, and payback period. These indicators determine whether your project is sustainable or overpriced. ROI is calculated by dividing annual net income by total investment cost, then multiplying by 100. Consistent monitoring ensures your investment stays profitable over time.

Step-by-Step Proforma

Start by adding all costs — land, construction, furnishings, and fees — to get total capital expenditure. Then, estimate monthly rent per bed, multiply by the total number of beds and occupancy rate to get gross income. Subtract management and maintenance costs to get net income. Finally, divide the annual net income by your total project cost to find ROI.

Converting m² Construction Costs to Per-Bed Capex

If construction costs average KSh 45,000 per m² and each bed requires about 10 m², you’re looking at KSh 450,000 per bed. Adjust this for finishing level, location, and utility installations. This figure helps you determine if the expected rent aligns with your target ROI. It’s a vital benchmark for comparing hostel investments across towns.

Worked Proforma: Nairobi vs County Town

In Nairobi, a well-located hostel charging KSh 12,000 per bed with 95% occupancy achieves around 14% ROI. In contrast, a county-town project charging KSh 6,000 per bed but achieving 98% occupancy can yield 16%. Both show that location and rent must be balanced carefully. Your profit depends more on occupancy consistency than high rent alone.

Construction & Development Costs

Typical Construction Costs

The hostel construction cost in Kenya varies between KSh 40,000 and KSh 65,000 per m². Multi-storey designs are more efficient, providing more beds within the same plot. Construction material prices fluctuate, so locking in suppliers early reduces cost risks. Professional supervision ensures adherence to budget and safety standards.

Non-Construction Capex

Beyond the structure, you’ll need to budget for beds, furniture, Wi-Fi, and laundry installations. These items add comfort and directly impact rent levels. Furnished hostels tend to attract students faster and retain them longer. Quality furnishings also lower maintenance frequency over time.

Permits & Statutory Fees

Investors should allocate 2–4% of total project costs for approvals from NEMA, NCA, and county planning departments. Delays often occur when documentation isn’t complete. Hiring a project manager to coordinate approvals saves time and avoids penalties. Compliance ensures smooth operations and easier resale.

Contingency Planning

A 10% contingency fund is necessary to manage inflation, material shortages, or unexpected construction issues. This reserve keeps the project on track even when challenges arise. Phased construction can help manage cash flow efficiently. Smart financial planning protects ROI from erosion.

Design Choices that Improve ROI

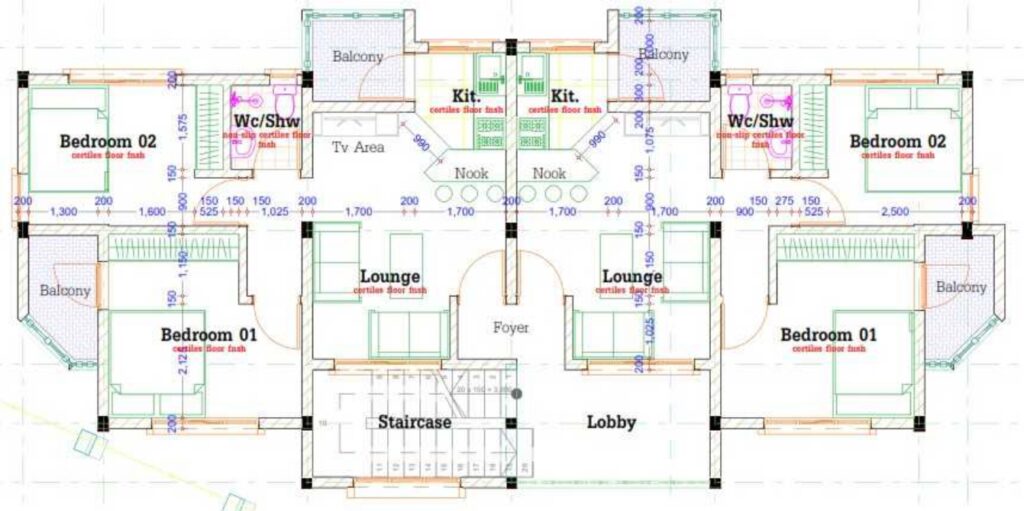

Unit Mix Strategies

Design layouts influence ROI more than many investors realise. Smaller cluster rooms and shared facilities increase bed capacity per floor. Offering a few premium en-suites allows you to tap into higher-paying students. Blending affordability and comfort enhances long-term occupancy stability.

Space Efficiency

Avoid wasted hallways, overlarge lounges, or low-ceiling rooms. Maximising usable area means more rentable beds per square metre. Strategic placement of washrooms and study spaces makes living comfortable without wasting construction cost. Efficiency equals better ROI.

Prefabricated & Modular Options

Prefabricated systems shorten build time and cut costs by up to 20%. This accelerates rental income generation and improves return cycles. Modular structures are durable and environmentally friendly. They also allow for easy expansion when student numbers increase.

Safety & Compliance

Safety features such as fire exits, alarms, and emergency lighting are critical. They not only protect tenants but also raise the property’s market value. Proper compliance simplifies insurance approval and reduces liability risks. Safety investments always pay off.

Revenue Enhancement & Ancillary Income

Extra Revenue Streams

Adding income-generating amenities like vending machines, tuck shops, and laundry services increases your bottom line. These small ventures operate within the hostel premises and serve students directly. Even parking and printing services can generate consistent cash flow. Every additional service raises total ROI without major cost increases.

Dynamic Pricing

Rent flexibility ensures continuous occupancy. During high-demand months, rates can rise slightly, while discounts during holidays maintain steady cash inflow. Proper rent adjustments require knowing the academic calendar. This balance keeps occupancy above 90% yearly.

Technology & Management Tools

Using digital property management tools simplifies rent collection and maintenance tracking. Software platforms reduce manual work and minimise human error. They also give visibility into financial performance, allowing timely decisions. Smart management leads to sustained profitability.

Financing Structures & Tax Implications

Debt vs Equity

Deciding between loans and equity partners affects control and profits. Debt allows full ownership but adds repayment pressure. Equity partners share risk but dilute ownership. Choose the model that best fits your cash flow capacity and long-term goals.

Joint Ventures & Crowdfunding

Collaborations with landowners or developers reduce upfront capital requirements. Crowdfunding platforms let smaller investors co-own large projects. These modern methods open access to the lucrative student housing market for many Kenyans. They also spread financial risk across multiple contributors.

Tax & Depreciation Benefits

Hostel owners can benefit from depreciation allowances and deductible expenses. Proper record-keeping helps maximise these savings. Working with a tax expert ensures compliance and legal profit retention. Efficient taxation planning directly improves your net ROI.

Risk Analysis & Mitigations

Seasonality & Vacancy

Vacancy peaks during semester breaks can hurt revenue. To offset this, rent out rooms short-term to interns or visiting lecturers. Some investors convert empty rooms into affordable Airbnb units during holidays. Flexibility ensures continuous income flow.

Regulatory & Zoning Risks

County zoning restrictions may limit hostel construction in certain areas. Always confirm land-use compliance before breaking ground. Obtain all required permits and environmental clearances. Ignoring these steps can lead to demolition or costly fines.

Construction & Quality Risks

Substandard materials or poor supervision can lead to long-term maintenance costs. Always engage qualified contractors and maintain strict quality control. Conduct regular inspections to prevent structural issues. Quality ensures safety, reputation, and consistent rental income.

Operations Management & Tenant Retention

Effective On-Site Management

Hiring a reliable caretaker or property manager ensures smooth daily operations. Their presence maintains order, cleanliness, and tenant satisfaction. Good management also prevents vandalism and late rent payments. A well-run property commands loyalty and referrals.

Communication & Feedback Systems

Regular student feedback helps improve services and fix issues quickly. Creating WhatsApp or SMS channels for maintenance reports keeps everyone connected. Students feel valued when their concerns are heard promptly. This responsiveness boosts your reputation and tenant retention.

Exit Strategies & Resale Value

Resale to Institutional Buyers

Large-scale developers or REITs often buy performing hostels for portfolio expansion. A fully occupied, compliant property commands premium resale value. Keeping your books transparent and income verifiable helps secure buyers faster. Strategic exits can multiply your initial ROI.

Long-Term Leasing to Universities

Leasing your hostel to a nearby university guarantees predictable returns. Such agreements often last 5–10 years and reduce vacancy risk. Universities prefer ready-built housing that meets safety and capacity standards. This partnership model provides long-term stability.

Technology Integration in Modern Hostels

Smart Security Systems

Installing CCTV and biometric access systems improves safety and attracts tenants. Parents also prefer secure environments for their children. Smart security reduces theft and improves trust in your facility. It’s both a selling point and a protection measure.

Internet & Connectivity Solutions

Reliable Wi-Fi is a non-negotiable requirement in modern hostels. Fast internet enhances study conditions and keeps occupancy high. Investing in strong network infrastructure pays off through consistent renewals. Students choose comfort and connectivity over basic accommodation.

Sustainability & Energy Efficiency

Solar & Water Recycling Systems

Installing solar panels and water recycling systems lowers operational costs significantly. These green investments reduce dependence on grid electricity and lower bills. They also appeal to environmentally conscious students. Sustainable practices can boost your property’s marketability and ROI.

Eco-Friendly Building Materials

Using locally sourced materials and low-VOC paints enhances air quality and reduces carbon footprint. Sustainable materials also attract modern investors seeking ESG-compliant projects. The long-term savings from durability justify the initial cost. Green design equals long-term profitability.

Marketing & Branding Your Hostel

Online Presence & Reviews

Creating a Google Business profile and maintaining social media pages increases visibility. Students search online before visiting physical hostels. Positive reviews and quick responses boost trust and bookings. Consistent branding attracts referrals and steady occupancy.

Partnerships with Institutions

Signing MOUs with nearby universities guarantees continuous referrals. Institutions prefer recommending reliable, safe hostels to their students. This partnership adds credibility and reduces marketing costs. Align your pricing and standards with institutional expectations for better results.

Scaling Up: From One Hostel to a Portfolio

Replication Strategy

Once your first hostel succeeds, use the profits to fund another project. Replication reduces financing pressure and accelerates income growth. By diversifying locations, you balance risks and increase total ROI. Smart scaling builds generational wealth.

Forming a Student Housing Brand

Establishing a brand across towns creates recognition and trust. Consistency in design and service helps attract tenants easily. Branding also raises resale and partnership opportunities. It transforms your hostels from properties into a business empire.

Digital Transformation and Smart Management in Student Hostels

How Technology Improves ROI in Modern Student Hostels

Technology is rapidly redefining how student hostels in Kenya are managed and optimised for profit. Smart management systems automate rent collection, energy monitoring, and maintenance schedules, reducing operational costs significantly. Hostel owners can now use digital dashboards to track occupancy rates, tenant satisfaction, and monthly revenues in real time. These insights allow faster decision-making and help prevent revenue leaks. Integrating mobile payment options like M-Pesa also improves cash flow and transparency. Moreover, using data analytics helps investors forecast demand during academic seasons, ensuring rooms are never underutilised. Ultimately, tech-driven management enhances efficiency, boosts tenant trust, and maximises ROI over time.

Role of Smart Energy Solutions in Cost Reduction

Energy efficiency directly influences the profitability of student hostels, especially in urban areas like Nairobi and Eldoret. Smart energy systems, such as prepaid meters and solar integration, lower long-term operational costs. By installing motion-sensor lights and automated heating controls, hostel owners can reduce unnecessary electricity consumption. This not only decreases monthly utility bills but also positions the property as environmentally friendly, which appeals to modern students. Investing in renewable energy also helps hedge against rising electricity prices in Kenya. Additionally, government incentives for solar adoption further enhance return potential. Through consistent energy management, hostel investors can significantly improve their long-term net income and asset valuation.

Automation of Tenant Communication and Maintenance Requests

Effective communication between hostel managers and tenants is crucial for operational success. Automated messaging systems allow instant updates on rent due dates, cleaning schedules, and maintenance notices. This creates a smoother experience for students and reduces manual workload for managers. Platforms like WhatsApp Business, integrated with CRM tools, can log complaints and service requests systematically. When issues are addressed quickly, tenant retention improves, minimising costly vacancies. Additionally, digital recordkeeping helps identify recurring maintenance problems early, allowing preventive repairs rather than expensive emergency fixes. Over time, this level of automation enhances customer satisfaction and contributes to stronger, more predictable cash flows.

Market Expansion and Diversification Opportunities in Student Housing

Emerging University Towns and Regional Investment Potential

Beyond Nairobi, secondary university towns like Kisii, Kakamega, and Meru are emerging as profitable investment zones. These towns have expanding student populations and limited quality accommodation, creating high demand for new hostels. Investors entering early can secure land at lower costs while benefiting from rapid appreciation as universities expand. The smaller competition in these areas allows for faster ROI and brand dominance. Additionally, government devolution policies are stimulating growth in local economies, indirectly supporting student housing demand. By targeting these regional hubs, investors can diversify geographically while maintaining strong occupancy levels. Such expansion reduces dependence on saturated markets and balances long-term portfolio risk.

Converting Existing Properties into Student Hostels

Many property owners overlook the potential of converting existing residential buildings into purpose-built student housing. This adaptive reuse model saves initial construction costs and reduces time to market. By redesigning interior layouts into shared rooms and common areas, investors can increase per-square-meter revenue. Conversions also appeal to universities seeking nearby housing partnerships, providing a consistent tenant base. Strategic renovations like adding Wi-Fi, study zones, and security systems greatly enhance appeal and justify higher rent. The shorter setup period allows investors to begin earning within months, not years. Overall, conversion projects provide a faster entry route into the student housing market with reduced financial exposure.

Partnering with Universities and Private Developers

Collaborations between private investors and learning institutions can accelerate student housing development. Universities often prefer outsourcing accommodation to experienced property managers, creating reliable tenancy pipelines. By entering joint ventures or leasing agreements, investors can ensure guaranteed occupancy and consistent rental income. Developers can also leverage university brand credibility to attract both parents and students. Additionally, public-private partnerships often receive favorable financing terms and tax incentives. Strategic alliances with large developers can further reduce construction and marketing risks. Through such partnerships, investors enjoy scalability, predictability, and long-term stability in their hostel ventures.

Conclusion

The ROI of student hostels in Kenya continues to outperform many other property classes due to consistent demand, strong occupancy, and multiple income streams. Smart investors who focus on cost efficiency, strategic design, and professional management achieve payback in record time. By applying the methods outlined in this guide, you can build a sustainable, high-yield investment. The student housing investment in Kenya remains a long-term opportunity for those ready to act now.