Explore high-growth retail property investment in Kenya. Discover demand hotspots, ROI potential, risks, financing, and legal tips for commercial investors.

Introduction

Investment in retail space in Kenya is experiencing significant growth. Expanding consumer demand, rising urban populations, and new commercial corridors are driving interest in retail property investment Kenya.

For investors, understanding the dynamics of retail space demand, potential returns, and location hotspots is critical. This guide provides a complete framework for profitable retail property investment opportunities in both major cities and emerging towns.

Retail Market Landscape in Kenya

Historical Growth & Evolution of Retail Space

Retail property investment in Kenya has evolved significantly over the last two decades. Early developments were concentrated in Nairobi’s central business district and a few regional malls. With urbanization and rising consumer spending, retail spaces have expanded into suburban areas and satellite towns. Investors are now exploring both modern malls and high-street retail shops to capture growing retail space demand.

Current Retail Demand & Occupancy Trends

Retail space demand in Kenya continues to increase, driven by rising disposable incomes and a growing middle class. Occupancy rates in prime malls and retail plazas in Nairobi, Mombasa, and Kisumu remain high, averaging 85–95%. Emerging towns also show a steady increase in occupancy due to the influx of small businesses and international retailers. Monitoring these trends is essential for profitable retail property investment in Kenya.

Retail Space vs Other Commercial Segments

Compared to offices and industrial properties, retail property offers unique advantages such as higher foot traffic and shorter lease cycles. Retail spaces often provide more immediate rental income and diversified tenant options. However, investors must carefully assess market saturation and location-specific demand to maximize returns. Understanding these dynamics helps investors position their portfolio strategically within the Kenyan commercial property market.

Role of International & Local Retailers in Market Growth

Both international brands and local retailers are driving retail space expansion in Kenya. Global chains increase demand for larger, well-located malls, while local businesses fill smaller retail hubs in emerging towns. This combination creates diverse rental income streams and increases the overall attractiveness of retail property investment Kenya. Tracking retailer expansion plans can help investors identify high-demand areas.

Key Retail Investment Hotspots & Demand Drivers

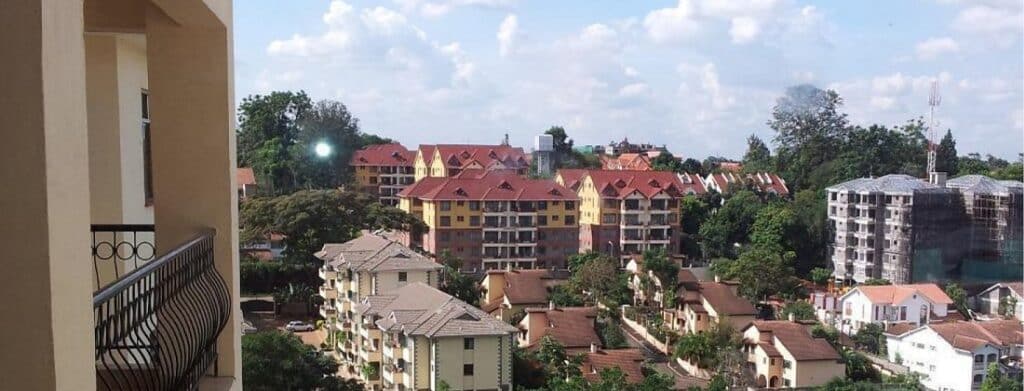

Nairobi Metropolitan Area Performance

Nairobi remains the top-performing retail property market in Kenya due to high population density and consumer spending. Prime locations like Westlands, Kilimani, and Karen attract both international and local retailers, maintaining strong rental yields. Despite some risk of oversupply in certain nodes, well-positioned retail spaces continue to deliver reliable returns. Investors often prefer these areas for a mix of short-term cash flow and long-term capital appreciation.

Secondary Cities and Growth Towns

Cities such as Nakuru, Kisumu, and Eldoret are emerging as high-potential retail investment hubs. These towns experience increasing retail space demand due to population growth and expanding middle-class consumption. Investors benefit from lower entry costs compared to Nairobi while still enjoying rising rental income. Identifying towns with infrastructure development plans can further enhance investment success.

Retail Space Demand Heatmap by Region

Retail space demand varies across Kenya, with high-demand regions centered around urban and peri-urban areas. Coastal cities like Mombasa and emerging towns in the Mt Kenya region show growing interest from retailers and investors alike. Analyzing this heatmap helps investors allocate capital effectively to areas with strong retail growth potential.

Influence of Infrastructure & Connectivity

Infrastructure projects such as new highways, bypasses, and improved public transport directly affect retail property value. Well-connected locations attract higher foot traffic and increase tenant interest, leading to higher rental yields. Investors should consider accessibility and planned infrastructure when evaluating retail properties for maximum return on investment.

Types of Retail Properties for Investment

Shopping Malls & Regional Centers

Shopping malls and regional centers are the backbone of retail property investment in Kenya. These properties attract anchor tenants like supermarkets, cinemas, and international brands, providing stable rental income. They also offer opportunities for capital appreciation in high-demand urban nodes. Investors should focus on location, tenant mix, and mall management to optimize returns.

High‑Street Retail Plazas & Street Fronts

High-street retail plazas and street-front shops offer direct exposure to high foot traffic areas. They are ideal for investors seeking smaller entry capital while targeting popular urban neighborhoods. Retail space demand in these locations remains strong due to consistent local consumer activity. Evaluating lease agreements and tenant reliability is essential for success.

Strip Malls & Community Retail Hubs

Strip malls and community retail hubs are increasingly popular in suburban and peri-urban areas. They cater to neighborhood shoppers, providing daily essentials and services. These properties usually have lower vacancy risks and consistent rental income, making them attractive for mid-level investors. Strategic placement near residential areas ensures sustainable tenant demand.

Mixed‑Use Developments with Retail Anchors

Mixed-use developments combine residential, office, and retail spaces to create high-traffic environments. Retail anchors in these developments benefit from built-in customer bases and predictable foot traffic. Investors can diversify income streams while tapping into emerging urban zones. Choosing the right development ensures both short-term rental income and long-term capital growth.

Commercial Property Investment Economics & ROI

Calculating Rental Yields & Capital Appreciation

Understanding rental yields and capital appreciation is critical for retail property investment Kenya. Rental yield shows the annual return based on rental income relative to property cost, while capital appreciation measures the increase in property value over time. Combining both metrics gives investors a realistic picture of potential ROI. Using this approach, investors can compare retail property against other commercial investments for better portfolio decisions.

Retail Space Demand vs Vacancy Rates

Retail space demand and vacancy rates are key indicators of market health. High demand coupled with low vacancy rates in areas like Nairobi, Mombasa, and Nakuru signals strong income potential. Conversely, areas with oversupply may reduce rental rates and occupancy, impacting investor returns. Monitoring these trends helps investors identify high-performing retail properties before committing capital.

Financing Options & Cost Structures

Investors can fund retail property through bank loans, private equity, or partnerships. Loan interest rates, deposit requirements, and repayment periods directly affect net returns. Cost structures also include property taxes, maintenance fees, and insurance, which must be factored into ROI calculations. Understanding financing options ensures strategic investment decisions and maximizes profitability.

Legal, Financial & Operational Considerations

Land Title, Zoning & Compliance

Verifying land title and zoning regulations is crucial before investing in retail property in Kenya. Proper compliance avoids legal disputes and ensures smooth leasing operations. Investors should check county approvals, building permits, and adherence to planning regulations. A clear legal framework protects both capital and long-term income streams.

Lease Structures & Tenant Agreements

Retail lease agreements determine income stability and risk exposure. Investors must evaluate lease length, rent escalation clauses, and tenant obligations. Anchor tenants in malls or plazas often negotiate long-term leases, ensuring steady cash flow. Structuring contracts effectively balances investor security with tenant flexibility.

Property Management & Maintenance Essentials

Efficient property management is essential for sustaining retail space demand and profitability. Regular maintenance, security, and tenant support enhance occupancy and rental income. Investors can either hire professional management firms or manage properties in-house depending on scale and expertise. Well-managed retail properties attract quality tenants and reduce long-term risks.

Retail Property Risks & Mitigation Strategies

Oversupply & Market Saturation Risks

Some urban areas in Kenya, particularly Nairobi, experience retail property oversupply. Excess space can lead to reduced rental rates and higher vacancy, affecting investor returns. Conducting thorough market research and selecting strategic locations mitigates oversupply risks. Investors should focus on high-demand nodes to secure stable income.

Impact of E‑commerce & Consumer Trends

The growth of e-commerce is shifting how retailers use physical space. While online shopping can reduce foot traffic for some outlets, hybrid retail models and experiential spaces remain in demand. Understanding changing consumer behavior allows investors to choose properties with tenants that adapt to these trends. This ensures consistent rental income and long-term viability.

Economic Volatility & Interest Cost Risks

Economic fluctuations, inflation, and rising interest rates can impact retail property returns. Higher borrowing costs and slower business growth can reduce rental income. Investors should incorporate economic scenario planning and diversify their property portfolio to manage financial risks effectively. A proactive approach protects capital and sustains long-term profitability.

Conclusion

Retail property continues to be one of Kenya’s strongest commercial investment options, especially in high-demand towns and main urban corridors. With careful location selection and tenant mix planning, investors can achieve stable rental income and long-term capital growth.

Balancing risks through due diligence, understanding financing structures, and monitoring retail space demand are essential for maximizing returns. For investors willing to plan strategically, retail property investment Kenya offers a compelling opportunity for both short-term cash flow and long-term wealth creation. (Cytonn)