Discover practical steps, sample ROI models and financing options for real estate investment in Kitengela — build, buy or rent with confidence.

Introduction

If you’re looking at real estate investment in Kitengela, now is an excellent time. This fast-growing suburb just south of Nairobi offers a mix of affordability, strong demand and solid infrastructure. Whether you’re buying land, building apartments for rent or flipping a development, this guide will walk you through what to expect, how to calculate returns and how to make a smart purchase. Let’s get started.

Why real estate investment in Kitengela makes sense today

Strategic location & commute benefits

Kitengela sits roughly 30 km south of Nairobi, offering a suburban lifestyle with fast access to the city via Namanga Road. Its position within the Nairobi metropolitan region means demand from city‐workers wanting more space is rising.

Infrastructure upgrades & amenities

The area has recently seen major upgrades: better roads, piped water, fiber connectivity and new shopping malls have all been rolled out. These infrastructure investments boost both liveability and investor appeal.

Demand drivers & market growth

Population growth, rising middle‐income households and spill-over from Nairobi have created strong demand for housing, land and rentals. With land values already appreciating (about 13.1 % year-on-year for Kitengela) the upside is tangible.

Best property types to buy in Kitengela (transaction-focused)

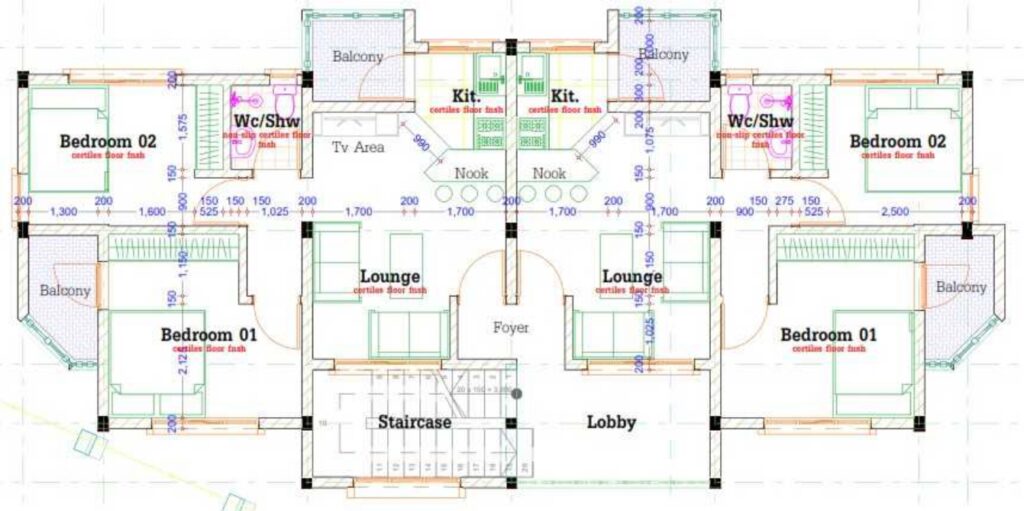

Buy-to-let apartments — rental appeal

Investing in apartments in Kitengela can yield consistent rental income thanks to high demand from workers and families. Look for units with 1-2 bedrooms or studios in gated estates for stronger occupancy and easier management of yield.

Plot development (50×100 / 1/8 acre) — buy & build play

Plots (50×100 ft or 1/8 acre) are popular for speculators and investors alike. With land prices still comparatively affordable, acquiring a plot with a plan to build and rent or flip is a realistic strategy.

Commercial & mixed-use opportunities

Beyond residential, Kitengela offers opportunities in retail kiosks, shopfronts and light warehouses – thanks to the growing industrial and logistics base. These asset types diversify income streams and can command higher yields.

Market pricing & benchmarks (numbers investors need)

Current land price bands

Recent listings show 50×100 ft plots selling for KSh 1.5 m to KSh 3.5 m in well-serviced locations. In emerging zones further out, prices start lower (~KSh 400k–1.2m).

Typical sale prices for houses & apartments

Houses in Kitengela range from about KSh 4.6 m for modest 3-bed units to KSh 12 m+ for more premium developments. This gives investors a sense of the capital required and potential rental rates.

Construction cost per sqm & holding costs

While exact figures vary, mid‐range construction costs in Kenya for suburban apartments currently range between KSh 45,000-70,000 per sqm depending on finishes. Investors must also budget ongoing costs like maintenance, utilities, security and property management – typically 5-10% of gross rent annually.

Expected ROI & proven proformas for Kitengela projects

How to calculate rental yield

Rental yield is calculated as (annual rent ÷ purchase cost) × 100. For example, if you spend KSh 10 m and rent brings in KSh 900k per year, yield is 9%. In Kitengela yields of 7-10% are being reported in good locations.

Case study: 6-unit rental block — sample numbers

Imagine building six 2-bed units at KSh 8 m total cost, and renting them at KSh 60,000 each monthly → annual rent = KSh 4.32 m. After costs and vacancy, net might be KSh 3.8 m → cash‐on‐cash ~47% (on KSh 8 m) in the first full year. Then capital appreciation could add ~10% a year based on recent land/appreciation data (~13.1%).

Capital appreciation: outlook & sensitivity

With land value growth in Kitengela around 13% year-on-year, the value of your asset is likely to rise. However, if costs overrun or rental demand drops, your effective ROI drops – always run a “worst-case” scenario.

Financing, taxes & returns — what funds look like in Kenya

Mortgages, construction loans & bridging finance

Kenyan banks and lenders offer mortgages often up to 70-80% LTV on completed properties; construction loans may cover 60-70% of build cost. You may also use developer financing or bridging loans during build phases – crucial for cashflow planning.

Tax & fees: stamp duty, VAT, rental income tax

When buying land or property in Kitengela you’ll face transfer fees (e.g., stamp duty ~4% of property value), VAT on construction materials (16% standard in Kenya), and annual rental‐income tax for non‐resident owners. Budget for these so they don’t erode your returns.

Grants, diaspora routes & pension‐fund co-investment

Some diaspora programmes and pension fund schemes offer co-investment in real estate in Kenya. These can provide access to capital and structured returns – worth exploring if you seek higher leverage or diversification.

Step-by-step process to buy land and build in Kitengela (transaction funnel)

Land due diligence checklist

Before purchase, always check: * title deed authenticity (LR No.), * survey plan, * encumbrances, * zoning (residential vs commercial), * access to utilities. Skipping due diligence is where many investors go wrong.

Local approvals & permits (Kajiado County)

Once you purchase, you must submit building plans to Kajiado County Government for approval, obtain NEMA clearance if required, secure connection permits for water/sewer/electricity and get foundation inspection sign-off. These steps can take weeks or months, so plan accordingly.

Hiring contractors, contracts & supervision

Select a licensed contractor (NCA in Kenya), sign a detailed contract with payment schedule tied to milestones (e.g., foundation, roofing, finishing). Regular supervision against schedule and cost is vital as cost overruns reduce ROI.

Market entry strategies & exit plans (transaction-first guidance)

Buy-and-hold (cashflow) strategy

This strategy focuses on acquiring a property (or building one) and holding it for rental income. In Kitengela, aim for units with strong tenant demand, moderate entry cost, and manageable maintenance – so your cashflow becomes reliable while you benefit from appreciation.

Build-to-sell (developer flip) strategy

Here you buy land, build, then sell once finished. The upside can be higher short-term gains but the risks too (time, market shift, cost overrun). Use high-finish spec if you intend to flip, and aim to market early.

JV/partnerships & exit routes

If full purchase is beyond your capital, consider partnering with local developers or investors. Agree clear exit plans: whether sale, refinance or long-term hold and how profits will be split. Having a predefined exit helps protect your investment.

Risk checklist & mitigation (practical investor controls)

Title risks & verification best‐practice

Title disputes are common in Kenya. Always check the transfer history, ensure there are no caveats, verify auto-registration and that there are no pending mortgages on the title. Using a reputable conveyancing lawyer is non‐negotiable.

Permit & infrastructure delay risks

Even if you have land, you may face delays in getting building approvals, sitting water/electricity connections or access roads. Budget a contingency (typically 10-15% of cost) and build a time buffer into your ROI model.

Market saturation & vacancy risk

As areas become trendy, too much new supply may hit rental or resale demand. Check vacancies in comparable estates in Kitengela, and keep your property spec flexible (e.g., ability to pivot to short-term rental).

Contractor & workmanship risk

Poor workmanship leads to high maintenance or early refurbishment – both eat returns. Mitigate by using licensed contractors, written warranties, book inspection sign-offs and hold a retention fund until defects are cleared.

Tools & freebies (conversion assets to capture leads)

Download: Kitengela ROI calculator

Include a free downloadable spreadsheet where investors can plug in cost, rent, vacancy, growth assumptions and see estimated IRR, payback and cashflow. This tool helps turn readers into leads.

Download: Due diligence checklist PDF

Offer a PDF checklist that walks through land title verification, approvals, cost checks and contract terms – a practical takeaway for serious investors.

Interactive: sample pro-forma for building a 6-unit block

Embed a simple interactive table (online or spreadsheet link) with sample assumptions: cost KSh 8m, rent KSh 60k/unit, growth 10%/yr etc. Allow users to adjust inputs and view results.

Future Growth and Appreciation Forecast for Kitengela

Kitengela’s real estate market is riding on a powerful wave of urban expansion and infrastructure development. Once a simple satellite town, it has grown into one of the most active investment zones in Kenya, attracting developers, homeowners, and diaspora investors. The consistent property appreciation — averaging 8–12% annually — has turned Kitengela into a strategic choice for long-term investors seeking both stability and growth. The town’s location along the Nairobi–Namanga Highway and proximity to the expressway make it a convenient suburb with great potential for value multiplication.

Upcoming Infrastructure and Urban Projects

Major projects such as the Greater Southern Bypass, the planned Konza Tech City linkage, and ongoing industrial park developments continue to strengthen Kitengela’s investment outlook. Improved feeder roads now connect previously inaccessible estates, opening up new residential and commercial opportunities. As Nairobi expands outward, Kitengela’s integration into the metropolitan blueprint guarantees sustained appreciation for early investors. These factors combined make it one of the few regions where land still offers affordable entry but high long-term rewards.

Economic and Demographic Trends Driving Demand

Kitengela’s booming population and economic activity are key factors sustaining property demand. The area’s growth is driven by middle-income earners seeking affordable housing alternatives to Nairobi’s high rents. The continuous migration of young professionals, students, and families ensures that property owners enjoy steady rental demand, translating into consistent income streams and reduced vacancy rates.

Employment, Education, and Lifestyle Factors

The establishment of schools, universities, and industries around Kitengela has created a self-sustaining ecosystem that supports both residential and commercial growth. Industrial parks and factories in neighboring Athi River offer thousands of jobs, while new shopping malls, hospitals, and entertainment centers continue to enhance quality of life. These developments attract tenants who prefer living close to work, thereby boosting the rental yield for apartment owners. As a result, Kitengela’s population surge continues to create unmatched demand for well-built, affordable housing options.

Sustainability and Green Real Estate Trends

Modern investors are increasingly focusing on sustainable and eco-friendly developments, and Kitengela is slowly becoming a leader in that transition. With growing awareness of climate change and energy costs, both developers and homeowners are adopting green designs, renewable energy sources, and water recycling systems. These upgrades not only reduce operating expenses but also increase property value and tenant appeal.

Green Building Advantages

Eco-conscious properties often achieve higher rent and attract long-term tenants, especially in gated communities. Developers now integrate solar power, rainwater harvesting, and waste recycling into residential units to meet this rising demand. Kitengela’s open landscape also allows easy integration of such technologies without significant construction barriers. Sustainability isn’t just a global trend — in Kitengela, it’s fast becoming a defining factor for modern property buyers and tenants who want affordable, environmentally responsible homes.

Expert Investment Tips and Case Studies from Kitengela Developers

Experienced investors have shown that with proper research and location choice, returns in Kitengela can outperform most other Nairobi satellite towns. Understanding local market patterns and aligning your property type with tenant demand ensures optimal returns and lower management stress.

Case Study: Multi-Unit Apartment Strategy

A Kitengela investor built a 6-unit apartment block near the Acacia area with modern finishes targeting working couples. Each unit rents for KSh 22,000 per month, generating KSh 132,000 monthly income. With total construction and land costs of around KSh 11 million, the project yields an annual return of over 14%, excluding appreciation. The key was selecting a site with road access, water connection, and nearby social amenities — ensuring both quick occupancy and long-term value growth.

Pro Tips from Local Developers

Experts advise investors to avoid speculative land purchases without title deeds, as they carry legal risks and delays. Instead, focus on serviced plots with ready infrastructure or joint venture projects with reputable developers. Timing also matters — entering before major infrastructure projects are completed often yields the highest appreciation. Patience, clear budgeting, and market awareness remain the ultimate success principles in Kitengela’s thriving real estate scene.

Future Investment Opportunities and Challenges Ahead

As Kitengela continues its urban transformation, new opportunities and challenges emerge that will shape the next decade of real estate investment. The increasing demand for modern rental housing, the rise of smart gated estates, and the expansion of commercial zones near the highway all create immense potential for forward-thinking investors. However, with rapid development also comes competition, infrastructure pressure, and the need for better planning.

Opportunities in New Estates and Mixed-Use Projects

New gated communities such as Yukos Heights and Acacia Gardens are redefining Kitengela’s housing standards, offering investors a chance to enter premium developments early. There’s also rising demand for mixed-use buildings that combine shops, offices, and residential units — ideal for young entrepreneurs and SMEs. Despite the challenges of market saturation and regulation, investors who plan early, monitor emerging zones, and focus on value addition are set to reap exceptional rewards in Kitengela’s future.

Conclusion

As you’ve seen, real estate investment in Kitengela offers a compelling combination of growth, affordability and demand. With strategic planning, careful due diligence and realistic modelling of returns, you can secure strong rental yields and capital appreciation. Whether you’re buying a plot, building rental units or flipping a development, keep your process disciplined, your numbers conservative and your exit strategy clear. Remember: the best time to act may be now.