Discover profitable holiday homes and Airbnb investments in Coastal Kenya. Explore costs, legal requirements, ROI factors, risks, and how to choose the right location for maximum rental returns.

Introduction

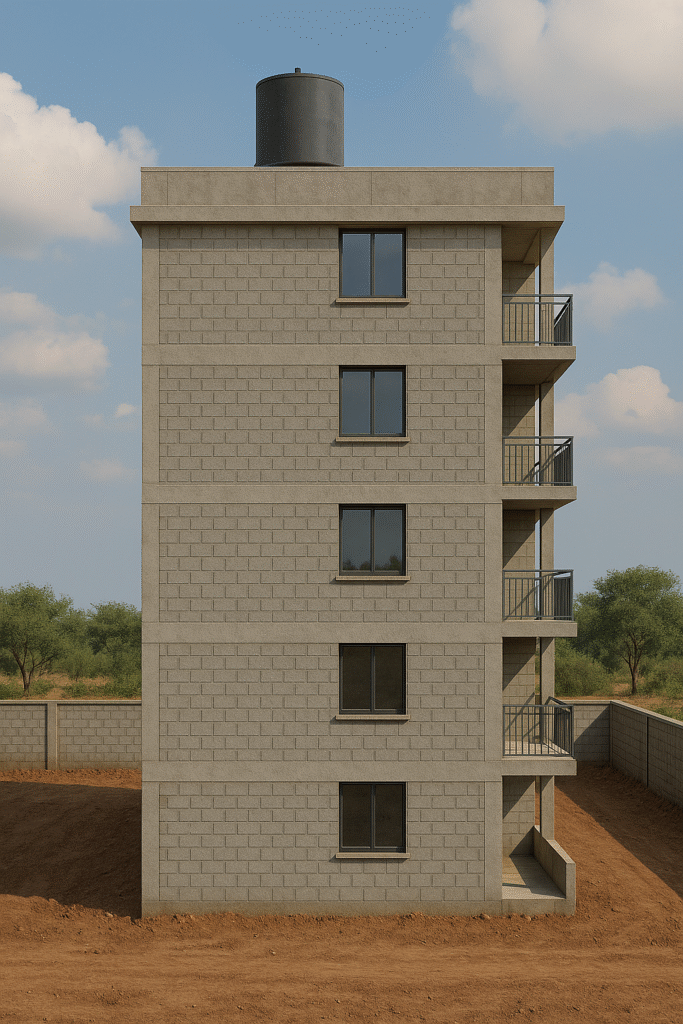

Holiday Homes and Airbnb Investments in Coastal Kenya

Holiday Homes in Coastal Kenya are fast becoming one of the most attractive real estate investment options for both local and diaspora investors. Strong tourism recovery, improved infrastructure, and consistent Airbnb demand are driving interest in beachfront and resort-style properties across the coast.

Investors are increasingly choosing holiday homes because they offer a mix of lifestyle value and steady rental income. Popular destinations like Diani, Nyali, Watamu, and Malindi continue to record high occupancy rates, especially during peak travel seasons.

With Airbnb investments in Coastal Kenya, property owners can earn short-term rental income while benefiting from long-term capital appreciation. This makes holiday homes a practical option for investors seeking flexible use, higher yields, and exposure to Kenya’s growing tourism economy.

Why Holiday Home Investments Matter in Coastal Kenya

Tourism Growth and Airbnb Demand Trends

Coastal Kenya continues to benefit from steady tourism growth driven by international visitors and strong domestic travel. Beach destinations attract holidaymakers throughout the year, creating consistent demand for short-term stays.

This rise in travel has directly increased demand for holiday homes listed on Airbnb and similar platforms. Investors benefit from higher occupancy rates, especially during peak seasons and public holidays.

Shift from Long-Term Rentals to Short-Term Airbnb

Many investors are moving away from long-term rentals and focusing on Airbnb investments in Coastal Kenya. Short-term rentals often generate higher monthly returns compared to traditional leases.

Key reasons for this shift include:

- Flexible pricing based on season and demand

- Faster income growth during peak tourism periods

- Greater control over property use

This model allows owners to adjust strategies quickly as the market changes.

Lifestyle + Income Hybrid Investment Model

Holiday homes offer a unique advantage by combining personal use with income generation. Owners can enjoy the property during vacations while renting it out when not in use.

This hybrid model appeals to:

- Diaspora investors seeking a home base in Kenya

- Families planning long-term coastal living

- Investors looking for both lifestyle value and returns

It is a key reason holiday home investments in Coastal Kenya outperform many traditional property options.

Services Included in Holiday Home & Airbnb Investments

Property Acquisition & Development Services

Investors can choose from several entry options when investing in holiday homes. These include buying land, purchasing off-plan developments, or acquiring fully built turnkey properties.

Common services include:

- Land sourcing and verification

- Developer-led holiday home projects

- Ready-to-move-in beachfront properties

This flexibility allows investors to match their budget and risk level.

Interior Furnishing & Styling for Airbnb

Proper furnishing plays a major role in Airbnb performance, yet many competitors overlook this factor. Well-designed interiors attract better reviews and higher nightly rates.

High-impact furnishing elements include:

- Comfortable beds and quality linens

- Modern kitchens and reliable Wi-Fi

- Coastal-themed décor and outdoor seating

Strategic styling can significantly improve occupancy and returns.

Airbnb Setup, Listing & Management Services

Professional setup and management services simplify holiday home investments, especially for absentee owners. These services help maximise income while reducing daily involvement.

Typical services cover:

- Airbnb account setup and listing optimisation

- Guest communication and bookings

- Cleaning, maintenance, and key management

This makes Airbnb investments in Coastal Kenya more accessible to both local and overseas investors.

Cost Breakdown for Holiday Homes in Coastal Kenya

Property Purchase or Construction Costs

The cost of acquiring holiday homes in Coastal Kenya varies by location, size, and proximity to the beach. Prime areas like Diani and Nyali tend to have higher prices due to strong demand and developed infrastructure.

Watamu and Kilifi offer more affordable options while still delivering solid Airbnb potential. Investors should budget differently for land purchase, off-plan developments, or full construction projects.

Furnishing, Appliances & Smart Home Features

Furnishing is a major setup cost that directly affects Airbnb performance. Many investors underestimate this expense, yet it plays a key role in guest satisfaction and reviews.

Key cost areas include:

- Furniture, beds, and wardrobes

- Kitchen appliances and electronics

- Smart locks, CCTV, and backup power systems

Well-planned furnishing improves occupancy and allows higher nightly rates.

Ongoing Operational & Maintenance Costs

Running holiday homes involves recurring expenses that investors must plan for early. These costs affect net returns and long-term profitability.

Common operational costs include:

- Cleaning and laundry services

- Utilities such as water, electricity, and internet

- Security, repairs, and property management fees

Proper budgeting ensures stable cash flow throughout the year.

Factors Influencing Airbnb Investment Costs & Returns

Location & Beach Proximity

Location is one of the strongest drivers of Airbnb income in Coastal Kenya. Beachfront holiday homes typically earn more due to better views and direct beach access.

Inland properties cost less but may require better amenities or pricing strategies to compete. Understanding this balance helps investors choose the right entry point.

Seasonality & Occupancy Rates

Airbnb income along the coast is highly influenced by travel seasons. Peak seasons bring higher nightly rates, while low seasons require competitive pricing.

Smart investors adjust pricing by:

- Increasing rates during holidays and school breaks

- Offering discounts for longer stays in low seasons

- Using dynamic pricing tools

This approach helps maintain steady occupancy year-round.

Property Type & Amenities

The type of holiday home and available amenities strongly influence booking decisions. Guests often prioritise comfort, convenience, and reliability when choosing listings.

High-performing amenities include:

- Swimming pools and sea views

- Backup power and fast Wi-Fi

- Secure parking and outdoor relaxation areas

These features can significantly boost returns on Airbnb investments in Coastal Kenya.

Legal & Regulatory Considerations in Coastal Kenya

Title Deeds, Zoning & Land Use

Legal due diligence is critical when investing in holiday homes in Coastal Kenya. Investors must confirm that the title deed is genuine and that the land is approved for residential or tourism-related use.

Zoning restrictions can affect whether a property can legally operate as a short-term rental. Verifying ownership and land use early helps avoid disputes and future losses.

County Regulations & Tourism Licensing

Different coastal counties have specific regulations governing holiday homes and Airbnb operations. These may include business permits, tourism licenses, and environmental approvals.

Key compliance areas include:

- County business permits

- NEMA environmental approvals

- Tourism or hospitality registration where required

Following county rules protects your investment from penalties or shutdowns.

property legal checklist.

Taxation for Airbnb & Holiday Homes

Income earned from Airbnb investments in Coastal Kenya is subject to taxation. Investors must declare rental income and comply with applicable tax laws.

Important tax considerations include:

- Income tax on rental earnings

- VAT obligations for qualifying properties

- Withholding and annual tax returns

Proper tax planning improves compliance and protects long-term profitability.

How to Choose the Right Holiday Home Investment

Best Coastal Locations for Airbnb Investments

Location selection plays a major role in Airbnb success. Established areas like Diani, Nyali, Watamu, and Malindi continue to attract strong booking demand.

Emerging coastal towns offer lower entry prices and future growth potential. Investors should balance current income with long-term appreciation when choosing a location.

ROI Analysis & Break-Even Period

A clear ROI analysis helps investors understand how quickly a holiday home can start generating profit. This involves comparing monthly Airbnb income against operating and financing costs.

Some properties focus on strong cash flow, while others prioritise long-term value growth. Knowing your investment goal guides better decision-making.

Self-Managed vs Managed Airbnb Properties

Investors must decide whether to manage their Airbnb themselves or use professional management services. Each option has cost and effort implications.

Self-management offers higher control and lower fees, while managed properties provide convenience and consistency. This decision is especially important for diaspora investors.

Benefits of Holiday Homes & Airbnb Investments

High Rental Yields Compared to Long-Term Leasing

Holiday homes in Coastal Kenya often generate higher rental yields than long-term leases because Airbnb pricing adjusts daily based on demand. During peak tourism seasons, investors can earn in a few months what traditional rentals make in a full year. This flexibility makes holiday homes a stronger income option for coastal property investors.

Foreign & Diaspora Investor Appeal

Holiday homes strongly attract foreign and diaspora investors seeking income in stable foreign currencies such as USD or EUR. Airbnb investments in Coastal Kenya also act as a hedge against inflation while providing a personal vacation home. This dual advantage increases long-term investor confidence and demand.

Long-Term Capital Appreciation

Coastal infrastructure development continues to drive property value growth across Kenya’s shoreline. Improved roads, airports, and hospitality projects steadily increase demand for quality holiday homes. Over time, investors benefit from both rental income and rising property prices.

Common Risks in Coastal Holiday Home Investments

Market Saturation & Price Competition

As more investors enter the Airbnb market, competition in popular coastal towns continues to grow. Holiday homes that lack unique features may struggle with pricing pressure and lower occupancy. Differentiation through design, amenities, and professional management is key to staying competitive.

Regulatory Changes & Compliance Risks

County regulations and short-term rental rules can change over time, affecting holiday home operations. Investors who fail to stay compliant risk penalties or operational disruptions. Proper legal guidance helps future-proof Airbnb investments in Coastal Kenya.

Maintenance, Security & Weather Exposure

Coastal properties face higher maintenance demands due to salt air, humidity, and seasonal weather conditions. Without proper care, wear and tear can quickly reduce property value and guest satisfaction. Strong security measures and routine maintenance protect long-term returns.

Conclusion

Investing in holiday homes in Coastal Kenya offers a unique combination of lifestyle enjoyment, strong Airbnb income, and long-term capital growth. With careful location selection, compliance with legal and regulatory requirements, and proper property management, investors can achieve sustainable returns that often exceed traditional rental income.