Why Invest in Nairobi Apartments?

Key Demand Drivers for Rental Income in Nairobi

Urbanisation and population growth continue to push housing demand in Nairobi.

Expatriates and corporate workers fuel demand in prime Collective months, Westlands, and Lavington. NGO staff and international organisations often prefer serviced apartments for short or medium stays. Young professionals and students are driving up demand for affordable one- and two-bedroom units.

Short-Term vs Long-Term Rental Demand in Nairobi

Short-term/serviced apartments often deliver higher rental yields, especially in areas near the CBD and business hubs. Long-term residential leasing offers more stability, with steady cash flow and lower vacancy risk. The choice depends on your investment goals: maximising income (short-term) versus reducing risk (long-term). Some landlords use a hybrid strategy to balance both opportunities.

Market Snapshot: Rental Income Data & Nairobi Zones to Watch

Serviced Apartment Market Share by Suburb in Nairobi

Westlands, Kilimani, and Kileleshwa attract expats and corporate tenants.

Serviced apartments here often achieve higher occupancy and rental yields.

Satellite towns like Ruaka and Syokimau are seeing growth in mid-income demand.

Use a small table or chart to compare occupancy and yield by suburb.

2023–2025 Trends in Nairobi Apartment Rentals

Occupancy rates are stable in mid-market suburbs but softening in luxury units. Pipeline projects in Kilimani and Upperhill may add pressure on rental prices. Oversupply risks exist in the premium segment, lowering yields for high-end apartments. Affordable and serviced segments continue to show stronger growth.

Suburb Heatmap: Where to Earn the Best Rental Income in Nairobi

High yield areas: Kilimani, Ruaka, Ngong Road (steady rental demand). Capital growth zones: Westlands, Upperhill, Lavington (long-term appreciation). Emerging hotspots: Ruiru, Syokimau, and along new expressways. Investors should balance yield vs appreciation depending on goals.

Understanding Rental Yield & Return in Nairobi

Gross Yield vs Net Yield in Nairobi Apartments

Gross rental yield = (Annual rent ÷ Property price) × 100. Net rental yield subtracts expenses like management fees, repairs, taxes, and vacancies.

Example:

A 2-bedroom apartment in Kilimani costs KES 12M. Monthly rent = KES 90,000 (KES 1.08M annually). Gross yield = 9%.

After 20% expenses, the net yield drops to 7.2%

This difference is critical when estimating real rental income from apartments in Nairobi.

Building a Localised Yield Table for Nairobi Suburb

Gather rent comps from property portals, agents, and market surveys. Focus on key zones: Kilimani, Westlands, Ruaka, Syokimau, Lavington.

Compare: Average property price, Typical monthly rent and Gross yield %

Create a downloadable Excel template so investors can input numbers and calculate yield instantly. A suburb yield table helps decide where to invest for the best returns.

Key Factors That Drive Higher Rental Income in Nairobi

Location: Why Proximity Matters for Rental Income

Apartments near the CBD, business parks, and transport links rent faster. Tenants pay more for access to schools, hospitals, malls, and offices. Areas along new roads or expressways often see higher yields and appreciation.

Always check if the suburb attracts your target tenant group (expats, students, corporates).

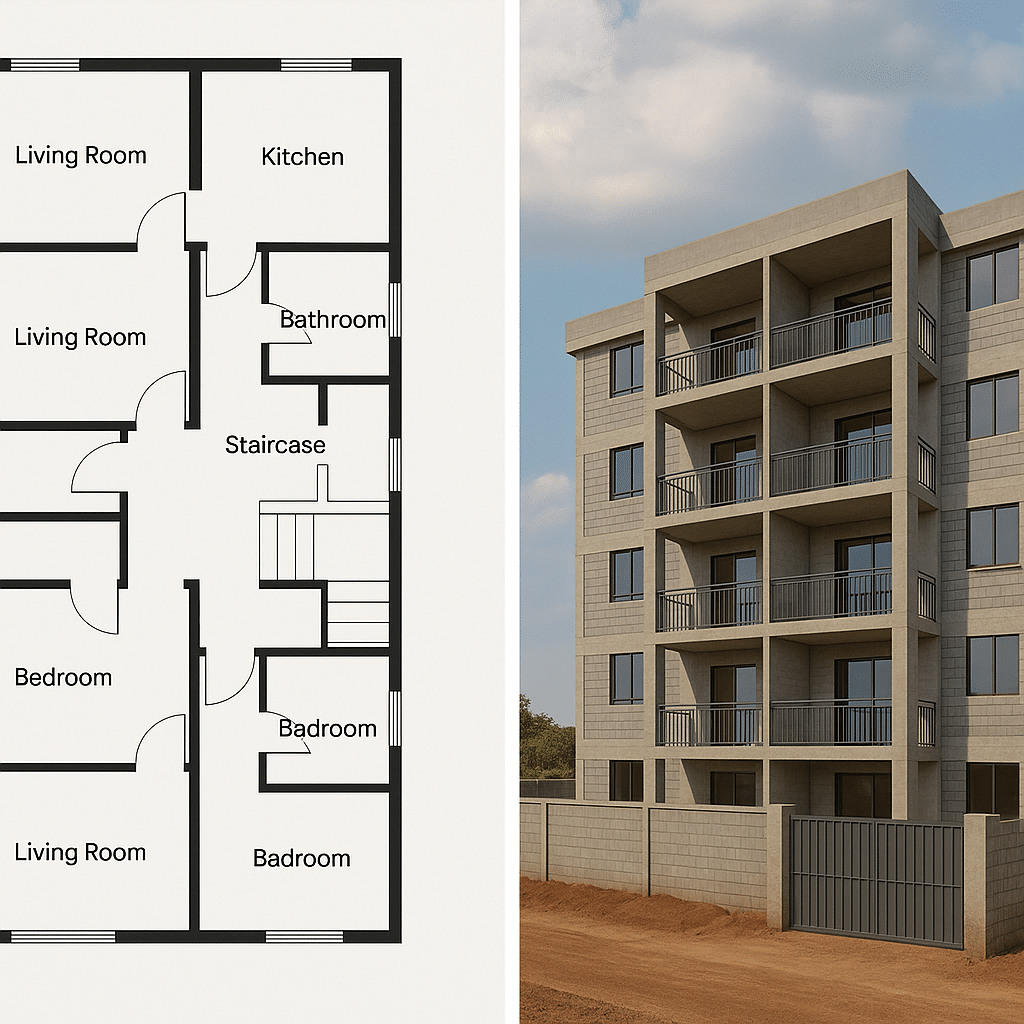

Unit Mix & Layout: What Rents Best in Nairobi Suburbs

Studios & 1BRs rent quickly in areas with students and young professionals.

2BR units perform well in middle-income suburbs like Ruaka and Ngong Road.

3BR and larger are in demand with families, especially in Lavington and Westlands. Smaller units often deliver higher rental yields per square foot.

Fit-Out & Furnishing: How to Boost Returns

Furnished apartments in Kilimani and Westlands earn higher short-term rental income. Unfurnished units offer stable long-term tenancies but lower monthly rent. Co-living and serviced apartments bring premium yields but require active management. Simple upgrades (paint, tiles, lighting) can increase rent by 5–15%.

Amenities That Justify Premium Rent in Nairobi Apartments

Reliable backup power and water storage, highly valued by tenants. 24/7 security, CCTV, and gated access attract expats and corporates. Parking spaces are a must-have for middle and upper-income tenants. High-speed internet is now a key factor in rental decisions. Properties with these extras often enjoy lower vacancies and higher rental yields.

Rental Models & Which One Fits Your Goal in Nairobi

Long-Term Residential Leasing in Nairobi

Offers steady rental income from apartments in Nairobi. Tenants usually sign 12-month leases with predictable cash flow. Lower management costs compared to short-term rentals. Works best in middle-income suburbs with strong local demand.

Short-Term & Serviced Apartment Rentals

Serviced apartments earn higher daily or weekly rent. Popular with expats, business travellers, and tourists. Requires active management and higher furnishing standards. Be best yields are in Westlands, Kilimani, and near airports.

Hybrid Rental Strategies (Mixing Models)

Combine short-term rentals during high season with long-term leases in low season. Helps balance vacancy risks with income growth.

Example: A 2BR in Kilimani can be leased to corporates long-term, then listed short-term during peak demand.

Build-to-Rent (BTR) Model in Nairobi

Emerging trend: apartments built specifically for rental income. Institutional investors are adopting this model in Nairobi’s growing suburbs.

Benefits: consistent occupancy, professional management, and stable yields. Suits investors with multiple units or larger developments.

Financials & Taxes for Rental Income from Apartments in Nairobi

Full Operating Expense Breakdown

Before calculating returns, factor in all expenses tied to Nairobi apartments: Property management fees: 8–12% of monthly rent.

Repairs & maintenance: plumbing, painting, appliances.

Insurance: covers fire, theft, and liability.

Utilities & service charges: water, security, waste, and internet.

Furnishing upkeep (if serviced or furnished).

Vacancy & Turnover Budgeting

Even the best-located apartments won’t be occupied 100% of the time.

Use this simple formula:

Vacancy Rate (%) = Vacant Days ÷ 365 × 100

Example:

Apartment vacant for 30 days = 8.2% vacancy rate. If rent is KSh 80,000/month, that’s KSh 78,000 lost annually. Budget at least 1–2 months’ rent per year for turnover and vacancies.

Rental Income Tax in Kenya

The KRA requires landlords to pay tax on rental income from apartments in Nairobi:

Monthly Residential Rental Income Tax: 7.5% of gross rent (for KSh 288,000–15M annually).

PAYE / Withholding: applies when corporates or agencies lease your units.

Commercial rentals may attract different VAT rules. Always file through iTax before the 20th of each month.

Mortgage & Financing Options for Buy-to-Let

Financing makes it easier to scale apartment investments in Nairobi:

Loan-to-Value (LTV): Banks typically finance 70–80% of property value.

Interest rates: ~13–15% (check CBK updates).

Repayment terms: 10–20 years, depending on the lender.

Special products: Some banks offer landlord mortgage packages for buy-to-let.

Tip: Always stress-test returns against a 2% interest rate rise to avoid cashflow shocks.

Due Diligence Checklist for Rental Income from Apartments in Nairobi

Title & Ardhi Search Steps, Leasehold Checks, Developer Track Record

Before committing money:

Title search at Ardhi House: confirm property ownership and encumbrances.

Leasehold checks: many Nairobi apartments sit on 99-year leases — confirm years left.

Developer reputation: review past projects, delivery timelines, and buyer complaints.

Off-plan buyers: verify escrow account compliance under the new Real Estate Act.

Building Approvals, Completion Certificates, HOA Rules & Sinking Fund

To avoid legal or structural issues:

County building approvals: ensure Nairobi County approvals are in place.

Completion & occupancy certificates: confirm the project meets safety codes.

Homeowners’ Association (HOA): review rules on pets, Airbnb, and subletting.

Sinking fund: check if there’s a reserve for future repairs (elevators, generators).

Tenancy Law Basics, Rent Escalation Clauses & Eviction Process

Kenya’s Landlord and Tenant laws regulate leases:

Tenancy agreements: include escalation clauses (typically 10–15% every 2 years).

Eviction process: must follow Tribunal or court procedures — illegal evictions risk penalties.

Notice periods: 1–3 months depending on lease type.

Deposit handling: document condition reports to avoid disputes.

How to Price & Launch Your Unit in Nairobi

Competitor Rent Survey: How to Collect Comps & Set Initial Rent

Setting the right rent is key to maximising rental income from apartments in Nairobi. Steps: Check property portals (BuyRentKenya, Jiji, HassConsult) for similar units. Visit competing buildings in the same suburb to ask for price lists.

Adjust for unit type: size, floor level, balcony, parking.

Start slightly below average to attract tenants faster, then revise after 6–12 months.

Marketing Channels for Nairobi Rentals

To avoid long vacancies, diversify marketing:

Agents & brokers: charge 1 month’s rent commission.

Property portals: BuyRentKenya, Property24, Lamudi.

Social media & Facebook groups: Nairobi Expat Marketplace, Kilimani Moms.

Short-term platforms: Airbnb, Booking.com for serviced units.

Corporate housing networks: useful for expat demand in Westlands & Kilimani.

Screening & Tenant Vetting Checklist

Bad tenants can erode your rental returns. Use a structured vetting process:

References: ask for landlord and employer contacts.

Employment proof: payslips, contracts, or business licenses.

Credit check: where available, or bank statement review.

Deposits: Collect 1–2 months’ rent as security. Tenant interview: discuss expectations on rent dates, utilities, and house rules.

Related post: Top 10 Modern 4 Bedroom Bungalow House Designs in Kenya (With Photos)

Operations & Scaling: Property Management, Tech & Automation

When to DIY vs Hire a Property Manager

Managing Nairobi apartments yourself saves money but takes time. Consider hiring a manager if: You own 3+ units or live far from the property. You want 24/7 tenant support without personal stress. You need professional tenant vetting & rent collection.

Fee benchmarks in Nairobi: 8–12% of the monthly rent for residential units. 15–20% for serviced/short-term apartments (includes bookings & cleaning).

Rent Collection Systems & Digital Payments in Kenya

Efficient collections improve rental income from apartments in Nairobi. Options include: M-Pesa Paybill or Till linked to your account. Bank standing orders for corporate tenants. Integrated rent management apps (e.g., Pesabazaar, PropertyPlus). Receipts & reminders sent automatically by SMS or email.

Preventive Maintenance Schedules, Software & Reporting Templates

Avoid costly breakdowns by creating a maintenance calendar:

Quarterly: plumbing, electrical, pest control.

Bi-annual: paint touch-ups, deep cleaning, security checks.

Annual: roof inspection, generator servicing, elevator checks.

Tools: Excel templates for smaller landlords.

Cloud-based systems (Buildium, Propertyware) for scaling portfolios.

KPI Dashboard (Occupancy, ARPU, Maintenance Cost %)

Tracking performance keeps investments profitable. Build a simple KPI dashboard:

Occupancy rate = rented units ÷ total units. ARPU (Average Revenue Per Unit) = total rent ÷ number of units. Maintenance cost % = maintenance spend ÷ rental income. Yield vs mortgage coverage = net rent ÷ monthly loan payments.

Related post: Top 10 Modern 4 Bedroom Bungalow House Designs in Kenya (With Photos)

Related post: PR032-15 units Mixed Bedsitter and One Bedroom House Plans in Kenya

Risk Management & Exit Strategies for Rental Income from Apartments in Nairobi

Market Risks (Oversupply / Demand Shifts) & Mitigation

The Nairobi rental market is dynamic. Risks include: Oversupply in Kilimani & Kileleshwa (drives rents down).

Demand shifts: expats moving to serviced apartments, corporates consolidating. Economic downturns: tenants downgrade to cheaper units.

Mitigation strategies:

Diversify across different suburbs (Westlands, satellite towns). Mix unit types (studios, 1BR, 2BR). Offer flexible leases (corporate & short-term rentals).

Insurance, Deposit Structures & Legal Protections. Protecting rental income means having safety nets in place: Insurance, fire, theft, and landlord liability.

Security deposit: 1–2 months’ rent, refundable if no damages. Legal contracts: written tenancy agreements covering rent, utilities,and repairs.

Dispute resolution: always follow Landlord & Tenant Tribunal processes.

When to Sell vs Hold — Trigger Checklist

Knowing when to exit ensures you capture maximum value.

Consider selling if: Yields fall below 6% net in your suburb. Maintenance & vacancy costs keep rising.

Market prices peak (flip for capital gains).

Consider holding if: Strong rental demand keeps units occupied. Long-term appreciation zones (Westlands, Upperhill, satellite towns). Mortgage is nearly repaid, maximising net returns.

Best house plans in Kenya and house designs in Kenya

Case Studies & Worked Examples on Rental Income from Apartments in Nairobi

2-Bed in Kilimani: Purchase Price → Rent → Yield → Net Cashflow

Imagine buying a 2-bedroom apartment in Kilimani at KSh 15 million. The unit rents to a corporate tenant at KSh 120,000 per month. Annual rent equals KSh 1.44 million. Gross yield works out to 9.6% (1.44M ÷ 15M). After 12% expenses for management and repairs (KSh 172,800) the investor takes home a net cash flow of about KSh 1.27 million per year.

Serviced Apartment in Westlands: Short-Term Model with Occupancy Sensitivity

A furnished 1-bedroom serviced apartment in Westlands costs about KSh 12 million.

At 50% occupancy with a nightly rate of KSh 6,000, the annual gross income is KSh 1.08 million. At 65% occupancy, income grows to KSh 1.4 million, pushing yields to 11–12%. At 80% occupancy, returns can hit KSh 1.7 million, or around 14% yield. This shows how the occupancy rate is the biggest driver of short-term rental returns.

Build-to-Rent (BTR) Sample Proforma

Now picture a 20-unit build-to-rent block in a Nairobi satellite town. Total development cost is around KSh 300 million, including land and construction. Each unit rents for about KSh 35,000 per month, adding up to KSh 8.4 million annually. After 15% in expenses (KSh 1.26M), the project nets about KSh 7.14 million NOI (net operating income). That equals a 2.3% yield initially, but long-term capital appreciation and stable occupancy make BTR attractive for patient investors.

Related post: Designing and Constructing Modern 5-Storey Commercial and Apartment Buildings: A Blueprint for Success

Actionable Checklists & Downloadables for Nairobi Apartment Investors

Pre-Purchase Due Diligence Checklist (Printable)

Before you invest in rental income from apartments in Nairobi, run through this quick checklist:

I. Confirm title deed ownership at Ardhi House.

ii. Check years remaining on leasehold (if not freehold).

iii. Verify Nairobi County building approvals & occupancy certificate.

iv. Research the developer’s past projects and delivery track record.

v. Inspect amenities: backup power, security, water storage.

vi. Review HOA rules and sinking fund policies.

vii. Compare rents of similar units in the suburb.

Tenant Move-In Checklist, Rent Review Schedule & Excel Projection

Once purchased, landlords should stay structured:

Tenant Move-In Checklist

i. Signed tenancy agreement.

ii. Deposit + 1st month rent received.

iii. Meter readings recorded (water, electricity).

iv. Inventory list for furnished units.

v. Tenant orientation on rules, contacts, and payments.

Rent Review Schedule.

Review rents every 12–24 months. Benchmark against market comps in your suburb. Insert escalation clauses (10–15% every 2 years where legal).

Related post: Cost of building a 4-bedroom Maisonette in Kenya

Excel Rent-Income Projection.

Track monthly rent, expenscash flowcashflow, and yield. Add formulas for vacancy rates and tax deductions. Helps test scenarios like “What if rent rises 10%?” or “What if occupancy drops?”

Downloadable idea: Offer a ready-to-use Excel spreadsheet for income projection.

FAQ on Rental Income from Apartments in Nairobi

Q1. What is the average rental yield for apartments in Nairobi?

Most suburbs deliver 6–10% gross yields, with serviced apartments sometimes hitting 12–14% if occupancy is strong.

Q2. Which Nairobi suburbs give the highest rental income?

Kilimani, Westlands, and Kileleshwa are strong for expats and corporates, while satellite towns like Syokimau and Ruaka give affordable entry points with good long-term growth.

Q3. How is rental income from apartments in Nairobi taxed?

KRA charges a 7.5% monthly rental income tax on gross rent (for landlords earning KSh 288K–15M annually). Filing is through iTax before the 20th of each month.

Q4. Is short-term rental more profitable than long-term leasing in Nairobi?

Yes, but only if you maintain high occupancy (65%+) and furnish to international standards. Long-term leasing offers steadier, lower-risk income.

Q5. What costs reduce rental income in Nairobi apartments?

Management fees, maintenance, insurance, service charges, utilities, and vacancy periods are the main deductions.

Q6. How do I screen tenants properly in Nairobi?

Ask for employer and landlord references, proof of income, and collect at least one month’s rent as a deposit. Always use a signed lease agreement.

Q7. Can I finance an apartment purchase in Nairobi for rental income?

Yes. Most banks offer 70–80% LTV mortgages at 13–15% interest, with repayment terms up to 20 years.

Q8. How do I calculate my net rental yield?

Take annual rent minus expenses, then divide by the purchase price. Example: KSh 1.44M rent – KSh 172K expenses = KSh 1.27M net ÷ 15M = 8.4% net yield.

Related post: Best Building and Construction Company in Kenya

Conclusion & Next Steps

Quick decision flowchart (buy, refurbish, or wait).

Buy now if yields are above 8%, location demand is rising, and financing terms are favorable. Refurbish if property is in a prime area but under-rented due to outdated finishes. Wait if market supply is overshooting demand or mortgage rates are too high.

Suggested next actions

Run a market survey in your target suburb (compare asking rents vs. actual signed leases). Contact a trusted property manager to understand realistic occupancy and costs. Download templates (due diligence checklist + rent projection sheet) to model your numbers before committing.

Related post: Secret Exposed! How much does it cost to build a 4-bedroom house in Kenya?(Updated 2025)

Pingback: Land Buying Process in Kenya – Step by Step (2025 Guide) - West Kenya Real Estate Ltd

Pingback: Civil Engineering vs Contractors – Key Differences

Pingback: 2-Bedroom House Designs: Embracing the Latest Architectural Trends of 2025

Pingback: Types of Foundations in Kenya – Costs & Pros/Cons - Construction in Kenya

Pingback: Land Transfer Costs in Kenya Explained - West Kenya Real Estate Ltd

Pingback: How to Calculate ROI in Real Estate Kenya [Step-by-Step Guide] - West Kenya Real Estate Shop

Pingback: 2-Bedroom Bungalow House Plan Kenya: Affordable & Practical Designs

Pingback: How to Buy Land in Kenya: A Safe, Complete Step-by-Step Guide - West Kenya Real Estate Ltd

Pingback: Structural Engineers in Kenya — Hire EBK-Registered Structural Engineers & Get a Free Quote

Pingback: Real Estate Market Trends in Kenya 2025 — What Buyers, Investors & Sellers Must Know - Real Estate Journal Kenya