Introduction

In recent years, Ruiru has transformed from a quiet satellite town into a bustling urban hub that’s attracting real estate investors across Kenya. Its strategic location and rapid urbanization have made it a top choice for those seeking high returns from rental developments.

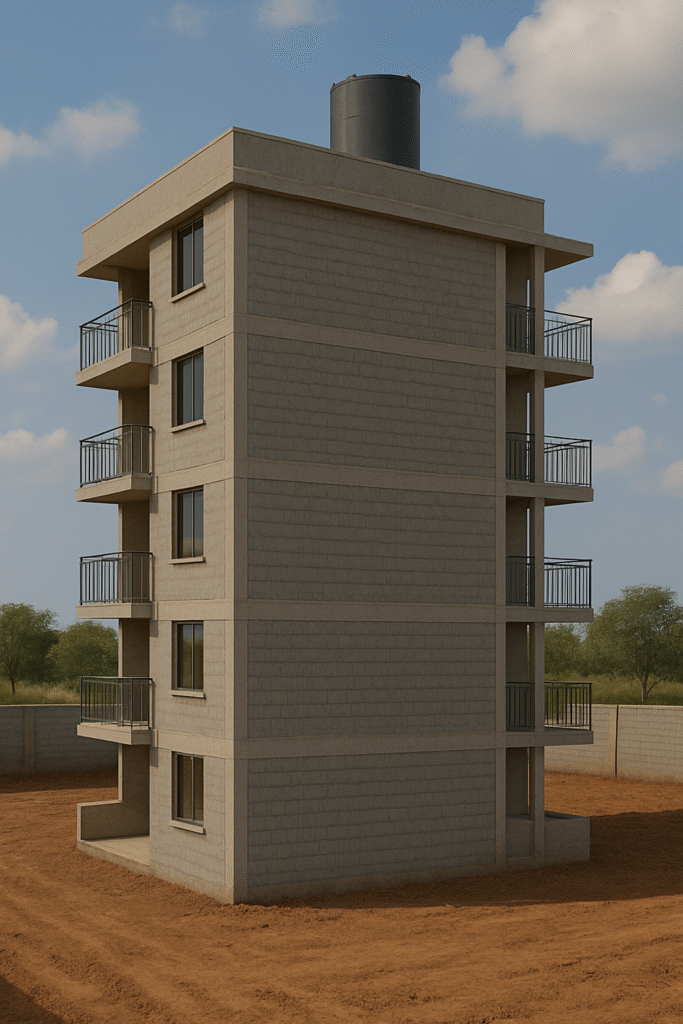

A common question investors ask is: “What kind of apartment can I build with Ksh 40 million in Ruiru?” This article breaks down the possibilities—from the number of units you can construct, to estimated rental income in Ruiru, and even your expected return on investment for apartments in Kenya.

If you’re considering a real estate investment in Ruiru, this comprehensive guide will help you understand what Ksh 40 million can achieve, which configurations work best, and how to maximize your profits in one of Kenya’s fastest-growing towns.

Related post: A Kshs 180 Million Apartment Design in Ruiru, Kiambu: Studio to 3-Bedroom Investment Opportunity

Why Ruiru is a Prime Location for Apartment Investment

1. Strategic Location and Infrastructure

Ruiru’s proximity to Nairobi CBD (about 26km), and accessibility via Thika Superhighway, Eastern Bypass, and the Nairobi Commuter Railway make it an excellent location for daily commuters. This connectivity fuels demand for rental housing among students, young professionals, and small families.

2. Rapid Urbanization and Population Growth

As of the latest census, Ruiru is among Kenya’s fastest-growing towns, recording a population growth of over 100% in the past decade. The town’s growth is driven by decongestion of Nairobi, affordable land, and increased commercial activity.

3. Educational and Commercial Developments

Institutions such as Zetech University, Kenyatta University Ruiru Campus, and multiple tertiary colleges are located in Ruiru. This has increased demand for student housing and affordable rental units. Hospitals, malls, and retail hubs like Tatu City, Spur Mall, and Kamakis Commercial Zone are fueling economic activity and rental demand.

Construction Budget Analysis: What Can Ksh 40 Million Build in Ruiru?

1. Construction Costs in Ruiru

The average apartment construction cost in Kenya ranges between Ksh 35,000 to 45,000 per sqm, depending on materials, finishes, and complexity. With a Ksh 40M budget, here’s what you’re working with:

- At Ksh 40,000/sqm → 1,000 sqm of buildable space

- At Ksh 35,000/sqm → ~1,143 sqm of buildable space

Related post: 700 Sq Ft 2 Bedroom Apartment Plans That Work in Kenya

2. Land Cost Consideration

If you already own land, the entire Ksh 40M goes into construction. However, for planning purposes, assume land in Ruiru costs between Ksh 5M to 8M for an eighth-acre plot. That would leave Ksh 32M–35M for building.

Related post: Top 600 Sq Ft Apartment Plans for 2 Bedroom Rentals

3. Apartment Unit Sizes

- Bedsitter: 20–30 sqm

- 1-Bedroom: 40–50 sqm

- 2-Bedroom: 60–80 sqm

4. Sample Configurations

Here are sample developments you can consider:

| Option | Unit Type | Avg. Unit Size | No. of Units | Estimated Build Cost |

| A | 2-Bedroom | 70 sqm | 16 units | 16 × 70 = 1120 sqm → Ksh 39.2M |

| B | 1-Bedroom + Bedsitters | 45 sqm + 25 sqm | 10 (1BR) + 10 (Bedsitter) = 20 | 10×45 + 10×25 = 700 sqm → Ksh 28–32M |

| C | 1-Bedroom only | 45 sqm | 20 units | 20 × 45 = 900 sqm → Ksh 31.5–36M |

These estimates assume 4–5 floors with 4–5 units per floor, maximizing vertical space on a standard 50×100 ft plot.

Rental Income Projections (Monthly & Annual)

Rental rates in Ruiru vary by estate and proximity to infrastructure. Average rental income in Ruiru is as follows:

- Bedsitter: Ksh 8,000–10,000

- 1-Bedroom: Ksh 12,000–15,000

- 2-Bedroom: Ksh 18,000–22,000

Rental Income Table

Let’s analyze the rental income potential of the configurations listed above.

| Option | Unit Type | No. of Units | Rent per Unit (Ksh) | Monthly Income (Ksh) | Annual Income (Ksh) |

| A | 2-Bedroom | 16 | 20,000 | 320,000 | 3.84M |

| B | 1-Bedroom | 10 | 14,000 | 140,000 | 1.68M |

| B | Bedsitter | 10 | 9,000 | 90,000 | 1.08M |

| B Total | Mixed | 20 | — | 230,000 | 2.76M |

| C | 1-Bedroom | 20 | 13,000 | 260,000 | 3.12M |

Clearly, Option A (16 2-bedroom units) yields the highest monthly and annual income, though the mixed-use Option B offers flexibility and targets a wider tenant base.

ROI Calculation: How Profitable Is the Ksh 40M Apartment Investment?

Let’s calculate real estate ROI in Ruiru using standard formulas:

Gross ROI Formula:

(Annual Rental Income ÷ Total Investment) × 100%

Net ROI Formula (after expenses):

((Annual Income – Expenses) ÷ Total Investment) × 100%

Sample ROI Scenarios

Assume operational expenses (maintenance, property management, void periods) at 12%.

| Option | Annual Income (Ksh) | Expenses (12%) | Net Income | Gross ROI (%) | Net ROI (%) |

| A | 3.84M | 460,800 | 3.38M | 9.6% | 8.45% |

| B | 2.76M | 331,200 | 2.43M | 6.9% | 6.08% |

| C | 3.12M | 374,400 | 2.75M | 7.8% | 6.88% |

Compared to land banking (~4% ROI), government bonds (~9–11%), or savings accounts (~3%), building an apartment in Ruiru offers competitive returns, especially considering potential appreciation.

Cost Factors That Can Affect Your Budget

Several hidden or underestimated costs can inflate your construction expenses if not properly planned:

- Approval & Regulatory Fees

- NEMA, NCA, county building permits

- Estimated at 2–3% of total cost

- Professional Fees

- Architect, structural engineer, quantity surveyor

- 5–8% of construction cost

- Utilities

- Water and electricity connections

- Sewer vs. septic system (Ruiru has limited sewer coverage)

- Contingencies

- Budget for at least 10% for inflation, delays, or design changes

Proper planning and a contingency buffer are crucial for success.

Related post: A Kshs 180 Million Apartment Design in Kikuyu, Kiambu: Studio to 3-Bedroom Investment Opportunity

Design and Unit Mix Tips to Maximize ROI

Choosing the best apartment to build in Ruiru depends not just on unit count but also your target market and cost-efficiency.

1. Target Market Focus

- Bedsitters & 1BRs: Ideal for students and singles—higher turnover, but easier to fill.

- 2-Bedroom Units: Suitable for young families and professionals—lower turnover, stable income.

2. Combine Unit Types

A mix of 1-bedrooms and bedsitters ensures constant occupancy and cushions against market shifts.

3. Maximize Plot Use

- Use vertical space with 4–5 floors

- Ensure ample natural light, access ways, and ventilation

- Parking for at least 6–10 cars (or more, depending on target tenants)

4. Keep Finishes Cost-Effective

Use modern but durable finishes:

- Ceramic tiles

- UPVC windows

- Steel doors with woodgrain finish

Risks and Mitigation Strategies

1. Rental Defaults or Vacancies

- Conduct thorough tenant screening

- Use a property manager or caretaker

2. Cost Overruns

- Work with an experienced QS

- Build in a 10–15% contingency

3. Approval Delays

- Begin approvals early

- Hire professionals familiar with Ruiru county processes

Proactive risk management ensures your project stays on track and profitable.

Related post: Small 1 Bedroom Apartment Floor Plans That Attract Tenants

Conclusion: Best Use of Ksh 40M in Ruiru Apartment Development

So, what apartment can you build with Ksh 40 million in Ruiru?

- You can build 16 2-bedroom units or up to 24 mixed units (1BR and bedsitters) depending on your layout.

- Monthly income potential ranges from Ksh 230K to 320K, with annual income up to Ksh 3.84M.

- Net ROI can reach 8.5%, outperforming traditional investments like land banking and savings.

Whether you aim for maximum rental income, long-term appreciation, or both—Ruiru is a solid bet.

Thinking of building an apartment in Ruiru? Consult with experts in design and construction to help you plan, approve, and execute your project with clarity and cost-efficiency.