Making the right decision on whether or not you should buy a property can be very challenging and yet it’s a core step in investing in real estate

A property valuation is a detailed report of a property’s market value. This is defined by the International Valuation Standards Council as the estimated sale price “between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion”.

A property valuation offers benefits to both buyer and seller. In providing a clear indication of a property’s market value, it reduces a buyer’s risk of paying over the odds for a property; in offering a detailed analysis of a property’s weaknesses, it can help a seller decide which renovations to make to enhance a property’s value.

Why Property valuation is Important?

- Buying or selling of property: Valuation of property is important when buying or selling of property. Even if an individual wish to rent his property, valuation of property becomes important. The rent of a property is usually 6–10% of the estimated price of a property.

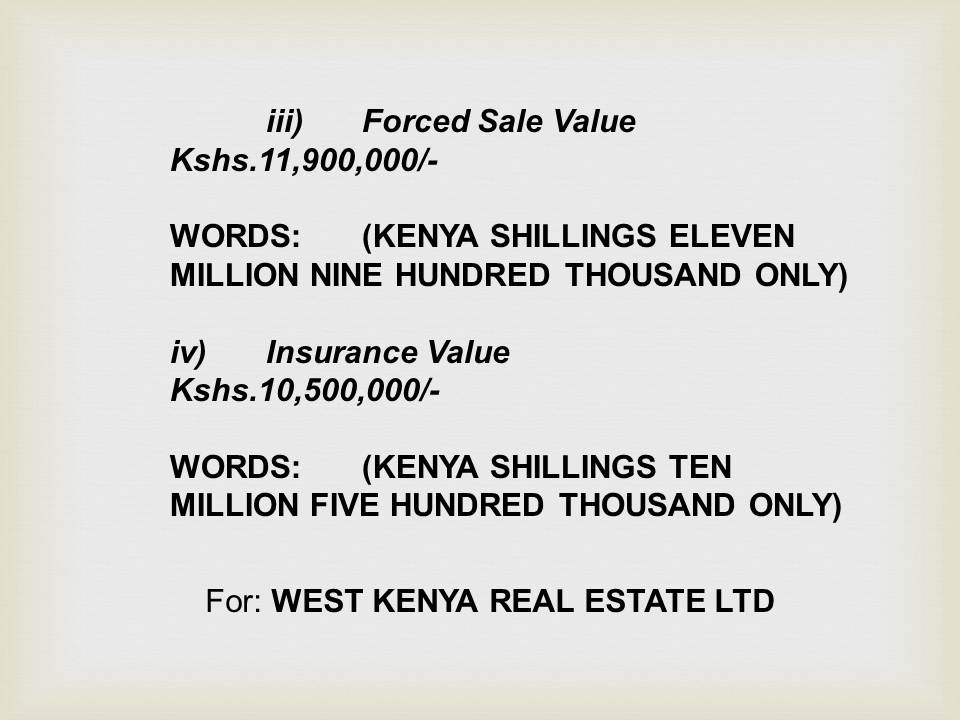

- To mortgage a property: The valuation of property is important when a buyer wishes to seek a loan against the security of property valuation is also done in case a loan for construction of a building is required.

- For taxation purpose: Valuation of property is important when calculating the tax on property. Taxes include wealth tax, municipal tax, property tax, vacant land tax, ground rent tax etc, which an individual has to pay to various government departments.

- For transfer of property: In case a person wishes to transfer his property, he will need to estimate the value of a property. The stamp duty is calculated on the basis of the worth of property.

- Compulsory Acquisition: In case an individual or an organization declares itself bankrupt and a compulsory acquisition or auctioning off the property is done, in such case the valuation of a property is important.

Talk to us today with your valuation need