Introduction to ROI in Real Estate Kenya

Importance of ROI for Investors in Kenya

Return on Investment (ROI) is one of the most critical metrics for property investors in Kenya. It shows how much profit you can earn relative to the money invested, making it easier to compare multiple investment options. Understanding urbanisation, investors focus on high-performing areas, whether in Nairobi, Mombasa, or emerging towns. It also assists in evaluating whether rental properties, commercial buildings, or land are worth the investment. Without calculating ROI, investors may miss opportunities or make costly mistakes. Accurate ROI analysis ensures your investment decisions are strategic and profitable.

Overview of the Kenyan Real Estate Market in 2025

The Kenyan real estate market is growing steadily in 2025, driven by urbanisation, rising demand for rental properties, and government initiatives in affordable housing. Prime urban areas prioritise Kilimani, Westlands, and Parklands, which offer some of the highest rental yields, attracting both local and international investors. Meanwhile, emerging towns provide opportunities for long-term capital appreciation. Market trends, property prices, and economic conditions all impact ROI, so investors must stay informed. Being aware of current market dynamics allows you to make smarter investment choices and reduce risks. A proper understanding of the market ensures that your ROI calculations reflect reality.

Key Metrics: ROI vs. Rental Yield

ROI and rental yield are related but different metrics that every investor should understand. ROI measures the total profit as a percentage of your total investment, while rental yield focuses specifically on rental income compared to property cost. Using both metrics together provides a clearer picture of a property’s performance. ROI helps identify the overall profitability of a property, while rental yield is useful for assessing cash flow. Combining these metrics helps investors prioritise properties that meet both short-term and long-term financial goals. This dual approach ensures informed investment decisions.

Understanding ROI in Real Estate

Definition of ROIprioritisen Investment (ROI) is a percentage that indicates how much profit a property generates compared to its total cost. In Kenya, ROI helps investors quickly understand whether a property is worth purchasing or renting. ROI in real estate is calculated by taking net profit and dividing it by the total investment, then multiplying by 100. ROI is especially important when comparing different properties in diverse regions, from Nairobi’s high-demand neighbourhoods to more affordable areas. Understanding ROI allows investors to make confident decisions based on financial data rather than guesswork. Accurate ROI calculations form the foundation for strategic property investments.

Difference Between ROI and Other Investment Metrics

While ROI measures total profitability, other metrics like Cash-on-Cash Return and Internal Rate of Return (IRR) focus on different aspects of investment performance. Cash-on-Cash Return looks only at the cash invested and the cash income it generates, ignoring appreciation. IRR considers projected future cash flow over a longer term, providing a more dynamic picture of returns. Knowing the difference helps investors choose the right metric for the type of property and investment horizon. Combining ROI with these metrics can offer a complete view of profitability. This allows investors to make informed decisions, avoid losses, and maximise returns.

Significance of ROI in Evaluating Property Investments

ROI is essential for comparing various property options in Kenya and determining whether the price and potential income justify the investment. It helps investors set realistic profit targets and avoid underperforming properties. Understanding ROI also enables better negotiation with sellers or landlords, as investors can justify offers based on expected returns. Additionally, ROI provides a clear metric for tracking performance over time and adjusting strategies as market conditions change. Investors who regularly evaluate ROI are better positioned to grow their property portfolios efficiently. Using ROI as a benchmark ensures investments are guided by data, not assumptions.

Calculating ROI: Step-by-Step Guide

Formula: ROI = (Net Profit / Total Investment) × 100

The standard formula for ROI is simple but powerful: ROI equals net profit divided by total investment, multiplied by 100. Net profit includes all income from the property minus expenses like maintenance, taxes, and management fees. Total investment accounts for purchase price, legal fees, and any renovation costs. This formula allows investors to convert profit into a percentage, making comparisons between properties easier. Understanding this formula is crucial for making informed investment decisions and projecting potential returns accurately. Accurate calculations reduce the risk of overestimating profits and help guide investment choices.

Example Calculation Using Kenyan Property Data

For example, if you buy a property for KES 8,000,000 and earn annual rental income of KES 960,000, with KES 160,000 in expenses, your net profit is KES 800,000. Using the formula, ROI = (800,000 ÷ 8,000,000) × 100 = 10%. This percentage shows the overall return on your investment for that year. Example calculations using local data make ROI easier to understand and more relevant to Kenyan investors. By applying this method, you can compare multiple properties and determine which offers the best returns. Using realistic figures ensures your ROI reflects actual performance.

Consideration of Factors Like Purchase Price, Rental Income, and Expenses

When calculating ROI, it is important to include all costs associated with the property, such as stamp duty, legal fees, and repairs. Rental income may not always be consistent due to vacancies or late payments, which can affect profitability. Market trends and future property value changes should also be factored in when projecting ROI. Properly considering all these factors ensures that the ROI calculation is realistic and actionable. Neglecting expenses or market variations can lead to overestimated returns. Investors who account for all variables make smarter, more reliable investment decisions.

Factors Analysing ROI in Kenya

Location and Neighbourhood Trends

The location of a property is one of the most significant factors affecting ROI in Kenyan real estate. Properties in prime areas such as Kilimani, Westlands, and Parklands typically have higher rental yields and faster appreciation. Proximity to amenities, minimise schools, maximise centres, and transport hubs can be maximised. Conversely, properties in less developed neighbourhoods may offer lower ROI, even if the purchase price is cheaper. Investors need to research local trends, including upcoming infrastructure projects, to understand potential returns. Selecting the right neighbourhood ensures that your investment generates sustainable profits.

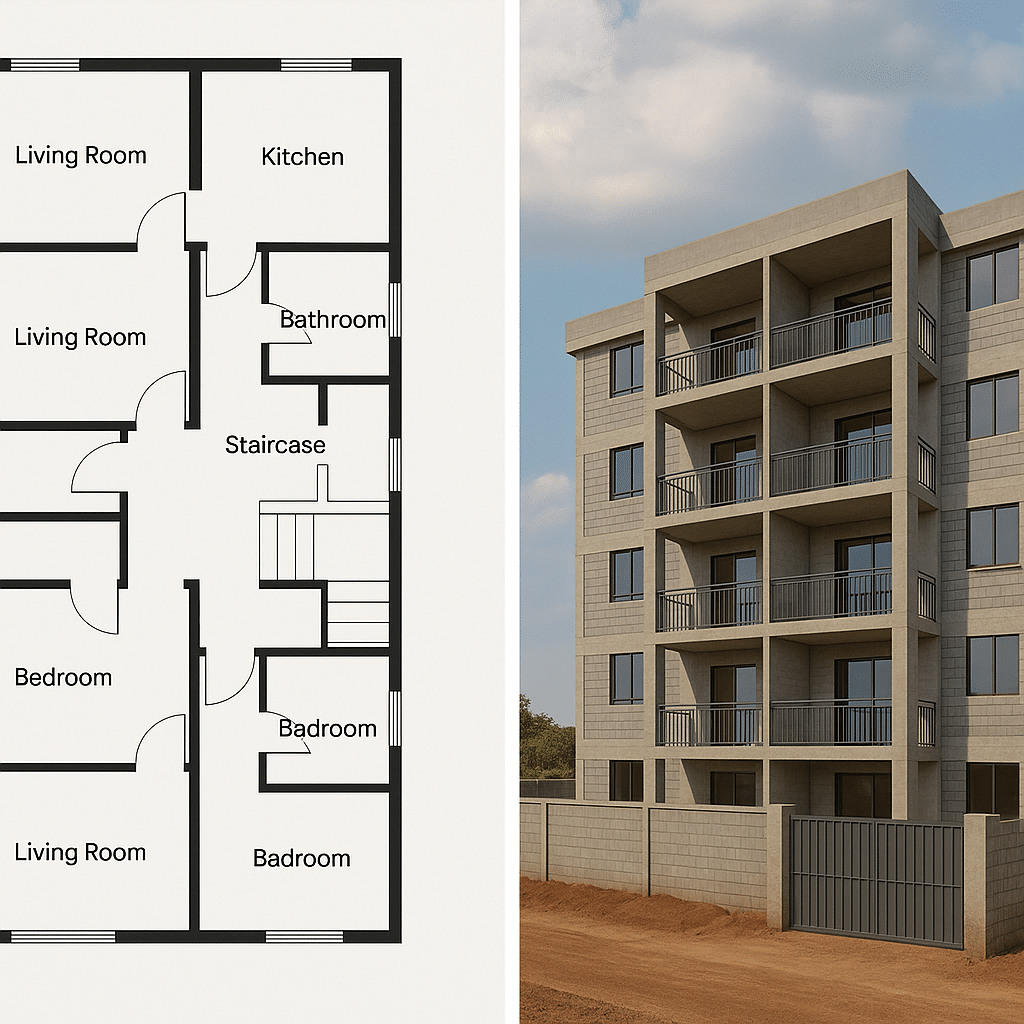

Property Type and Condition

The type and condition of a property also play a key role in ROI. Residential apartments, commercial spaces, and land all have different income potential and risks. Well-maintained properties require less immediate repair and attract higher-paying tenants, improving rental yield. On the other hand, older or poorly maintained properties may need significant renovations, lowering initial ROI. Property type affects both rental income and resale value, so choosing the right asset aligns with your investment goals. Investors should consider the long-term cost and revenue implications before purchasing.

Market Demand and Economic Factors

ROI is heavily influenced by local market demand and broader economic conditions. High demand for rental properties can increase occupancy rates and rental prices, boosting returns. Economic factors such as interest rates, inflation, ain nd GDP growth affect property affordability and market activity. Shifts in population and urbanisation trends also impact rental demand. Investors who monitor these variables can anticipate changes in ROI and adjust strategies accordingly. Understanding the market ensures that ROI calculations remain realistic and actionable.

Legal and Regulatory Considerations

Legal and regulatory issues in Kenya can affect property profitability and, by extension, ROI. Title deed verification, zoning laws, building permits, and tax obligations must be considered when investing. Non-compliance with regulations can lead to fines, delays, or even loss of property rights, significantly reducing returns. Investors should work with licensed professionals to ensure all documentation and approvals are in order. Factoring in legal considerations protects your investment and ensures ROI estimates are accurate.

Tools and Resources for Calculating ROI

Introduction to Return on Investment Calculators

ROI calculators are digital tools designed to simplify the process of evaluating property investments. They allow investors to input purchase price, rental income, expenses, and other variables to calculate expected returns instantly. Using a calculator ensures accuracy and saves time compared to manual calculations. Many online calculators are customised for Kenyan property data, making them highly relevant. Investors can use these tools to compare multiple properties and choose the most profitable option. ROI calculators are an essential resource for both new and experienced investors.

Overview of Available Tools for Investors

Several ROI calculation tools are available for foreign investors, including websites like Kings Developers and Murivest. These tools provide options for residential and commercial properties, considering local taxes and costs. Some calculators also factor in future appreciation and cash flow projections. Mobile apps and Excel templates can be used for offline calculations. Choosing the right tool depends on your investment goals and the level of detail you need. These resources help investors make informed decisions about the property portfolios.

Benefits of Using Calculators for Accurate Assessments

Using ROI calculators improves accuracy by considering all costs and income streams, including hidden expenses. They help investors forecast realistic returns, reducing the risk of overestimating profits. Calculators also allow for quick “what-if” scenarios, letting you test the impact of changes in rent, expenses, or market conditions. This functionality is crucial for strategic planning and comparison of multiple properties. By using these tools, investors save time, reduce errors, and make data-driven decisions.

Case Studies: ROI in Nairobi’s Prime Areas

Detailed Examples from Kilimani, Westlands, and Parklands

Prime Nairobi neighbourhoods such as Kilimani, Westlands, and Parklands consistently offer high ROI for property investors. For example, a two-bedroom apartment in Kilimani rented at KES 80,000 per month can provide strong annual returns after factoring in maintenance and management fees. Westlands commercial spaces show excellent rental income potential, while Parklands offers both residential and mixed-use investment opportunities. Real-life examples highlight how location, property type, and demand interact to determine ROI. These case studies guide investors in choosing profitable properties in Nairobi.

Analysis of Rental Yields and Appreciation Rates

Rental yields and property appreciation rates are key indicators of long-term ROI. Kilimani has shown steady annual appreciation, increasing property resale value over time. Westlands’ rental market provides high monthly income, boosting cash-on-cash returns. Comparing these metrics across neighbourhoods allows investors to balance short-term cash flow with long-term capital gains. Regular analysis ensures ROI expectations are realistic and investments remain profitable.

Comparison of ROI Across Different Property Types

Different property types in Nairobi yield varying returns. Residential apartments often provide consistent rental income, while commercial properties may offer higher but less predictable returns. Land investments rely mainly on appreciation over time, with minimal monthly cash flow. Comparing ROI across these types helps investors diversify portfolios and reduce risk. Understanding these differences ensures well-informed investment strategies that maximise profitability.

Common Mistakes to Avoid When Calculating ROI

Overlooking Hidden Costs

Many investors make the mistake of ignoring hidden costs when calculating ROI in Kenyan real estate. These include legal fees, stamp duty, renovation expenses, and ongoing maintenance. Neglecting these costs can significantly overstate ROI, leading to poor investment decisions. Accurate ROI calculation requires adding all potential expenses to avoid surprises. Being thorough ensures realistic projections and financial stability.

Ignoring Market Trends

Failing to consider market trends is another common error. Property prices and rental demand fluctuate based on economic conditions, urban development, and population growth. Ignoring these trends can result in lower-than-expected ROI. Monitoring market changes helps investors make timely adjustments and select properties with high growth potential.

Misinterpreting ROI Figures

Misinterpreting ROI can mislead investors, particularly if only short-term returns are considered. High ROI may not account for long-term expenses or market fluctuations. Conversely, lower ROI properties could offer better stability and growth over time. Understanding ROI in context allows investors to make balanced decisions that align with their financial goals.

Neglecting Long-Term Maintenance and Management Fees

Long-term maintenance and property management fees can significantly reduce ROI if not considered. Regular upkeep, repairs, and management costs are ongoing expenses that affect net profit. Neglecting these can lead to inflated ROI estimates and unexpected losses. Accurate ROI calculation always accounts for these recurring costs to ensure realistic projections.

Related post: Affordable Apartment Designs in Kenya Under 50 Million: Best Plans for High ROI

Advanced Metrics for Real Estate Investors

Cash-on-Cash Return

Cash-on-Cash Return measures the annual pre-tax cash flow relative to the cash invested in a property. Unlike ROI, which considers total investment including appreciation, this metric focuses only on cash input and income. It is particularly useful for investors relying on financing or mortgages. High Cash-on-Cash Return indicates strong immediate cash flow, while lower returns may signal potential liquidity issues. Understanding this metric helps investors prioritise properties that provide both income and long-term growth. Combining it with ROI offers a comprehensive view of investment performance.

Related post: Real Estate ROI Calculator in Kenya: A Practical Guide for Smart Investors

Internal Rate of Return (IRR)

Internal Rate of Return (IRR) estimates the annualised return on an investment, taking future cash flows into account. IRR is ideal for comparing projects with different timelines or cash flow patterns. For example, a property with slower appreciation but steady rental income may have a comparable IRR to a high-growth property with initial cash flow delays. Using IRR alongside ROI gives investors a deeper understanding of potential long-term profitability. It helps in forecasting returns under varying market conditions. Accurate IRR calculations can guide portfolio diversification and risk management strategies.

Gross Rent Multiplier (GRM)

Gross Rent Multiplier (GRM) is a simple metric that compares a property’s price to its annual rental income. GRM does not consider expenses, so it is best used for quick comparisons between properties. A lower GRM often indicates a better short-term investment, while a higher GRM may signal higher purchase costs relative to rental income. This metric is particularly useful for residential property investors in Nairobi and other urban areas. GRM helps identify which properties may deliver faster returns without extensive calculations. Combining GRM with ROI and Cash-on-Cash Return provides a complete financial picture.

When to Use These Metrics Alongside ROI

Investors should use these advanced metrics together with ROI for a balanced analysis. While ROI gives overall profitability, Cash-on-Cash Return shows immediate cash flow potential. IRR evaluates long-term returns, and GRM allows quick comparisons between properties. Using all metrics together ensures informed decision-making and reduces investment risk. These tools are particularly valuable in Kenya, where market conditions and property types vary widely. A comprehensive approach helps maximise both short-term and long-term ROI.

Understanding Rental Yields in Kenya

Average Rental Yields by Region

Rental yields in Kenya vary depending on location, property type, and demand. Prime areas like Kilimani and Westlands often yield 6–8% annually, while emerging towns may offer higher yields relative to purchase price. Residential apartments tend to have stable rental income, while commercial properties can generate higher but more variable returns. Knowing average yields helps investors set realistic expectations for ROI. Tracking regional differences ensures you invest in properties with strong income potential. Accurate rental yield data is crucial for calculating ROI in Kenyan real estate.

Factors Influencing Rental Yields

Several factors affect rental yields, including property location, tenant demand, maintenance costs, and economic conditions. Proximity to schools, offices, and transport hubs generally increases rental income. Property age and condition also play a role, as newer or well-maintained properties attract higher rents. Macroeconomic factors like interest rates, inflation, and employment rates influence tenants’ ability to pay. Understanding these factors ensures investors calculate realistic yields and anticipate potential ROI fluctuations.

Comparison of Rental Yields in Urban vs. Rural Areas

Urban areas typically offer higher rental yields due to strong demand and limited housing supply. Nairobi, Mombasa, and Kisumu are prime examples where investors can achieve steady cash flow. In contrast, rural areas may have lower yields but higher potential for property appreciation over time. Balancing urban and rural investments can diversify your portfolio and manage risk. Comparing yields across regions helps investors make strategic choices based on short-term income versus long-term growth. Accurate comparisons also improve ROI projections.

Related post: Apartment Investment in Thika: What You Can Build with Ksh 60M and the ROI You Can Expect

Conclusion and Investment Tips

Recap of Key Points

Calculating ROI in Kenyan real estate is essential for making informed investment decisions. Key points include understanding ROI formulas, considering all costs, analysing rental yields, and using advanced metrics like Cash-on-Cash Return, IRR, and GRM. Location, property type, market trends, and legal compliance significantly affect returns. Regular analysis and case studies help investors evaluate opportunities accurately. By focusing on these factors, investors can minimise risk and maximise profitability.

Strategies for Maximising ROI

To maximise ROI, consider investing in high-demand neighbourhoods, maintaining properties well, and using professional management services. Leverage ROI calculators to compare multiple properties and forecast returns. Diversifying across property types—residential, commercial, and land—can reduce risk. Monitoring market trends and economic factors allows timely adjustments to investment strategies. Strategic planning ensures both short-term cash flow and long-term appreciation.

Advice for Prospective Investors in Kenya

Prospective investors should conduct thorough research before purchasing properties. Verify title deeds, consult licensed professionals, and factor in all costs for accurate ROI projections. Focus on properties that balance rental income with appreciation potential. Using ROI and rental yield metrics together helps make data-driven decisions. Staying informed about the Kenyan real estate market ensures profitable, sustainable investments. Always plan for contingencies and long-term management to protect your returns.

Related post: What Apartment Can You Build with Ksh 40 Million in Ruiru? Unit Count, Rental Income & ROI Breakdown

Frequently Asked Questions (FAQ)

- What is ROI in real estate in Kenya?

ROI (Return on Investment) measures how much profit a property generates relative to the total money invested. It is usually expressed as a percentage and helps investors compare different properties and investment opportunities in Kenya.

- How do I calculate ROI for a rental property in Kenya?

To calculate ROI, use the formula: ROI = (Net Profit ÷ Total Investment) × 100. Include all costs, such as purchase price, legal fees, repairs, and taxes, and subtract annual rental expenses from income. This gives a realistic view of profitability.

- What is a good ROI for real estate investments in Kenya?

A good ROI depends on property type and location. Residential apartments in Nairobi may average 6–10%, while commercial spaces or land can offer higher long-term returns. Investors should compare ROI with market averages and other investment options.

- How can I use an ROI calculator for Kenyan properties?

ROI calculators let you input property cost, rental income, expenses, and other variables to get an instant ROI estimate. These tools save time, reduce calculation errors, and help compare multiple properties effectively.

- What factors affect ROI in Kenyan real estate?

Key factors include location, property type, market demand, maintenance costs, taxes, and legal compliance. Understanding these factors ensures accurate ROI calculations and smarter investment decisions.

- How does location influence property ROI in Kenya?

Properties in prime urban areas like Kilimani, Westlands, and Parklands typically have higher ROI due to rental demand and appreciation. Rural areas may have lower yields but potential for long-term growth. Location is critical for short-term cash flow and long-term returns.

- What are common mistakes when calculating ROI?

Common mistakes include ignoring hidden costs, misinterpreting ROI figures, overlooking market trends, and neglecting long-term maintenance and management fees. Avoiding these errors ensures realistic and reliable ROI estimates.

- Where can I find reliable ROI calculators for Kenyan real estate?

Reliable ROI calculators can be found on websites like Kings Developers, Murivest, and property investment platforms. Some also offer Excel templates or mobile apps customised for the Kenyan market data.

Related post: How to Maximise Rental Income from Apartments in Nairobi (2025 Guide)

Pingback: Best Location for Rentals in Kenya [2025 Guide] - West Kenya Real Estate Shop

Pingback: Modern 3BR House Plan in Kisumu: Affordable, Stylish, and Perfect for Family Living - West Kenya Real Estate Ltd

Pingback: Duplex House Designs Kenya: Modern, Affordable & Build-Ready Plans

Pingback: Real Estate Hotspots in Kenya: Where to Invest in 2025 - Real Estate Journal Kenya

Pingback: Bedsitter Apartment Plans Kenya: Downloadable Designs, Cost & Guide

Pingback: Cost of Roofing Sheets in Kenya — Ultimate Buying & Price Guide (2025) - Construction in Kenya

Pingback: Diaspora Investment in Real Estate Kenya: A Complete Guide for Kenyans Abroad - Real Estate Journal Kenya

Pingback: Rental Yield Kisumu vs Nakuru - West Kenya Real Estate Shop

Pingback: Real estate investment in Kitengela - West Kenya Real Estate Shop

Pingback: Luxury Home Designs in Kenya

Pingback: ROI of Bedsitters in Nairobi: How Profitable Are They? - West Kenya Real Estate Shop

Pingback: Duplex vs Villa House Plan Kenya

Pingback: Rental Income from Apartments in Syokimau — How to Maximise Returns & ROI - West Kenya Real Estate Shop

Pingback: Maximising Rental ROI along Thika Road (Nairobi) – A Practical Guide for Building Rentals & Rental Income Opportunities in Kenya - West Kenya Real Estate Shop

Pingback: Eco-Friendly House Designs in Kenya — Your Guide to Building a Sustainable Home

Pingback: ROI of Furnished Apartments in Nairobi for 2025 - West Kenya Real Estate Shop

Pingback: Common Mistakes to Avoid During House Construction in Kenya - Construction in Kenya

Pingback: Technology Disruption in Real Estate: PropTech Solutions in Kenya - Real Estate Journal Kenya

Pingback: Step‑by‑Step Guide to Building Apartments in Nairobi - Construction in Kenya

Pingback: ROI Build vs Buy Rentals Kenya – Should You Build Your Own Rentals or Buy Ready Apartments? - West Kenya Real Estate Shop

Pingback: Key Construction Equipment Used in Kenya and Their Functions - Construction in Kenya

Pingback: How to Calculate ROI in Real Estate Investments in Kenya - West Kenya Real Estate Shop

Pingback: Cost-Saving Tips for Building Rental Apartments in Kenya - West Kenya Real Estate Shop

Pingback: Top Emerging Real Estate Investment Areas in Kenya for 2025 - West Kenya Real Estate Shop

Pingback: House Plan Designs in Kenya: Choosing the Right Layout for Your Budget

Pingback: Property Valuation and Advisory Services in Kenya - West Kenya Real Estate Ltd

Pingback: Commercial Building Design and Drawing Services in Kenya

Pingback: Western Kenya Real Estate: Untapped Opportunities for Investors - West Kenya Real Estate Ltd

Pingback: Holiday Homes and Airbnb Investments in Coastal Kenya - West Kenya Real Estate Shop

Pingback: Student Housing Market Trends 2026: PBSA, Demand & Rental Insights - Real Estate Journal Kenya

Pingback: Warehouse Construction Services – Godown & Industrial Storage Facility Experts

Pingback: Why First-Time Investors Are Choosing Land Over Apartments - West Kenya Real Estate Shop

Pingback: Construction Automation in Kenya: The Future of the Construction Industry & How Automation Is Addressing the Labor Shortage - Construction in Kenya

Pingback: Buying Land In Emerging Towns: Risks vs Rewards Every Smart Investor Must Know - West Kenya Real Estate Shop